Global Double Block & Bleed (DBB) Valves Market 2025-2032

April 30, 2025Global Construction Equipment Telematics Market 2025-2032

September 17, 2025

Global Hydropower Turbine Market 2025-2032

$2695 – $4695

The hydropower turbine market is central to the global renewable energy landscape, encompassing the design, manufacturing, installation, and servicing of turbines that convert the kinetic and potential energy of water into rotational mechanical energy for electricity generation. This market provides the core technology for hydroelectric power plants, ranging from massive conventional dam-based installations to smaller, decentralized systems. A variety of turbine types, including Francis, Kaplan, and Pelton, are utilized, each specifically engineered to optimize energy capture based on distinct hydrological conditions, such as water head and flow rate.

| Single User | PDF Report, PDF Report + Dashboard (Multi-Users Access), PDF Report + Dashboard (Single User Access) |

|---|

Report Summary

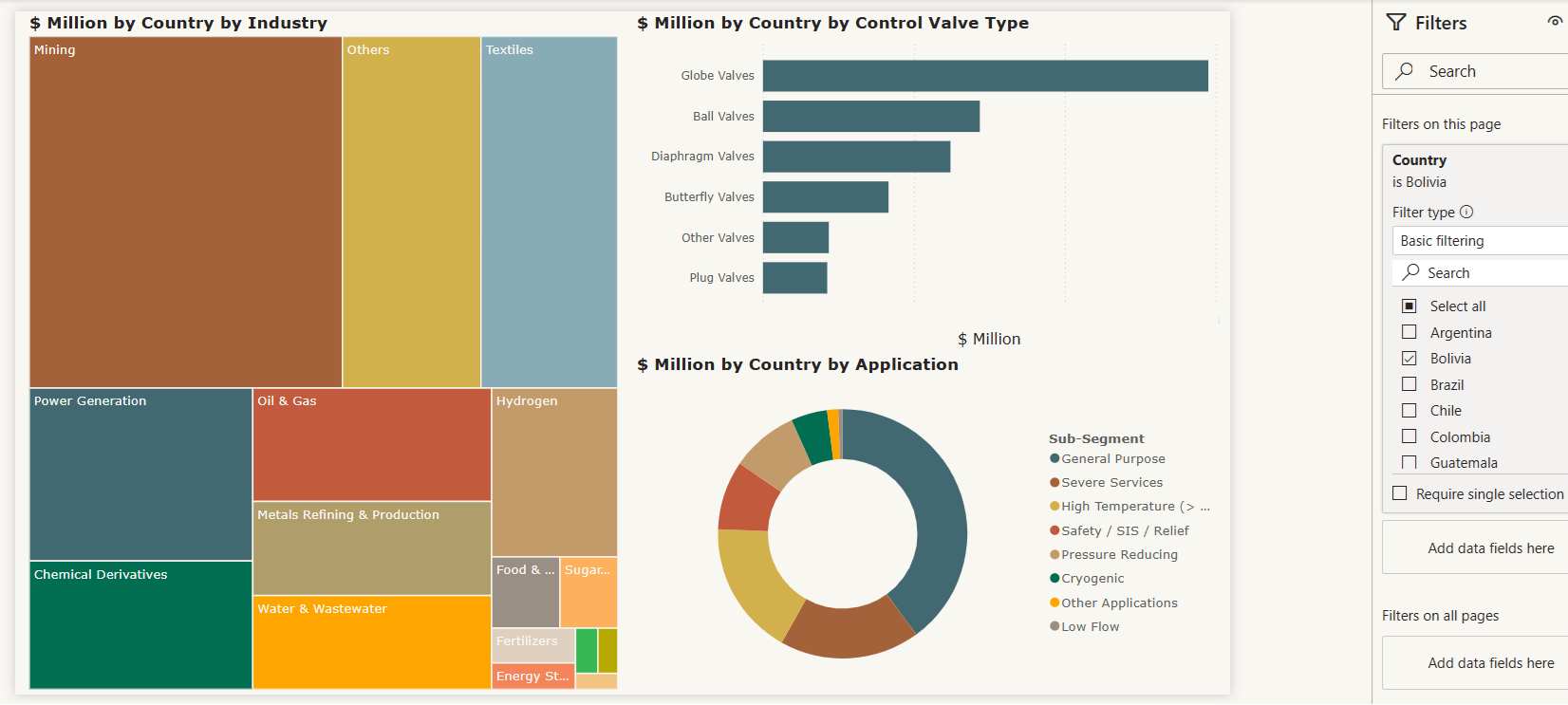

Revolutionize the way you engage with data through our cutting-edge interactive dashboard(Click to enlarge)

- The hydropower turbine market is central to the global renewable energy landscape, encompassing the design, manufacturing, installation, and servicing of turbines that convert the kinetic and potential energy of water into rotational mechanical energy for electricity generation. This market provides the core technology for hydroelectric power plants, ranging from massive conventional dam-based installations to smaller, decentralized systems. A variety of turbine types, including Francis, Kaplan, and Pelton, are utilized, each specifically engineered to optimize energy capture based on distinct hydrological conditions, such as water head and flow rate.

- This market is experiencing consistent growth, propelled by the escalating worldwide demand for clean and sustainable energy sources. Hydropower stands out as a mature and reliable renewable energy technology, offering significant advantages such as grid stability, the capacity for large-scale energy storage through pumped hydro, and exceptionally long operational lifespans for its assets. A substantial portion of market activity also stems from the modernization and upgrading of existing hydropower infrastructure, where the replacement or refurbishment of older turbines plays a key role in improving efficiency and boosting power output.

- Key trends shaping the hydropower turbine market include a notable shift towards the development and deployment of small and mini-hydropower projects, particularly aimed at providing localized and decentralized power solutions in remote or developing regions. Concurrently, there is an intense focus on enhancing turbine efficiency, ruggedness, and operational flexibility to better adapt to fluctuating water flows and dynamic grid demands. The integration of advanced digital technologies, including remote monitoring, predictive maintenance, and sophisticated control systems, is further optimizing the performance and reliability of hydropower plants.

- While the market navigates certain challenges, such as environmental concerns regarding river ecosystems and the substantial upfront capital expenditure associated with large-scale projects, the enduring benefits of hydropower as a reliable, stable, and sustainable energy source continue to drive innovation, investment, and its crucial role in the global energy transition.

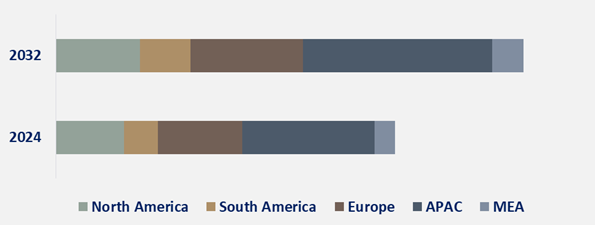

- Asia Pacific: The Asia Pacific region stands as the largest and most dynamic market for hydropower turbines, driven by enormous energy demand and significant investments in renewable energy infrastructure. Countries like China, India, and other Southeast Asian nations are heavily investing in both large-scale conventional hydropower projects and decentralized small hydropower schemes to meet growing electricity needs and achieve carbon reduction targets. The modernization and expansion of existing facilities also contribute significantly to the demand for new and upgraded turbines in this region.

- Europe: Europe represents a mature but stable market for hydropower turbines, with a strong focus on the modernization, refurbishment, and upgrading of existing hydropower plants. While new large-scale projects are less common due to environmental and geographical constraints, significant investment is directed towards enhancing the efficiency and lifespan of the continent’s extensive legacy hydropower infrastructure. Additionally, a growing emphasis on pumped-hydro storage solutions for grid stability and the integration of renewable energy sources is driving demand for specific turbine types in this region.

- North America: North America is another mature market where the emphasis is largely on the refurbishment and upgrading of existing hydropower facilities to extend their operational life and improve efficiency. With a vast installed base of hydropower, there’s a continuous need for turbine replacement and modernization to ensure reliable power generation. While new large-scale projects are limited, there’s growing interest in small hydropower development and pumped-hydro storage, driven by grid modernization efforts and the push for renewable energy integration.

- Latin America: Latin America is a significant and growing market for hydropower turbines, given the region’s abundant water resources and increasing energy demand. Countries like Brazil, Colombia, and Peru are actively developing new hydropower projects, including both large-scale conventional dams and smaller projects for rural electrification. The need to diversify energy mixes, reduce reliance on fossil fuels, and provide stable power to developing economies fuels substantial investment in hydropower infrastructure and, consequently, in turbine procurement.

Table of Content

1. Report Scope

1.1. Market Segmentation and scope

1.2. Regional Scope

1.3. Estimates and forecast timeline

2. Market Research Methodology

2.1. Research methodology and design

2.2. Sample selection

2.3. Reliability and validity

3. Executive Summary

4. Market Analysis

4.1. Market size and growth rates

4.2. Market growth drivers, market dynamics and trends

4.3. Market scenarios and opportunity forecasts

4.4. Market constraints and challenges

4.5. Industry value chain analysis

4.6. Industry analysis – Porter’s

4.6.1. Threat of new entrants

4.6.2. Bargaining power of suppliers

4.6.3. Bargaining power of buyers

4.6.4. Threat of substitutes

4.6.5. Competitive rivalry

4.7. PEST analysis

4.7.1. Political/legal landscape

4.7.2. Economic landscape

4.7.3. Social landscape

4.7.4. Technological landscape

5. Market Breakdown – by Type (Turbine Design)

5.1. Introduction

5.2. Francis Turbines

5.3. Kaplan Turbines

5.4. Pelton Turbines

5.5. Turgo Turbines

5.6. Archimedes Screw Turbines

5.7. Other Types

6. Market Breakdown – by Capacity (Power Output)

6.1. Introduction

6.2. Large Hydropower (typically >30 MW)

6.3. Medium Hydropower (typically 1 MW – 30 MW)

6.4. Small Hydropower (typically 100 kW – 1 MW)

6.5. Mini Hydropower (typically 10 kW – 100 kW)

6.6. Pico Hydropower (typically <10 kW)

7. Market Breakdown – by Head Type (Water Head / Drop)

7.1. Introduction

7.2. High Head

7.3. Medium Head

7.4. Low Head

8. Market Breakdown – by Application

8.1. Introduction

8.2. New Installations

8.3. Refurbishment & Modernization

8.4. Pumped Hydro Storage

9. Market Breakdown – by End-Use Sector

9.1. Introduction

9.2. Utilities & Power Generation Companies

9.3. Industrial Sector (for captive power)

9.4. Rural & Decentralized Power Solutions

9.5. Commercial Sector

10. Market Breakdown – by Geography

10.1. North America

10.1.1. North America Hydropower Turbine Market, 2024-2032

10.1.2. North America Hydropower Turbine Market, by Type

10.1.3. North America Hydropower Turbine Market, by Capacity

10.1.4. North America Hydropower Turbine Market, by Head Type

10.1.5. North America Hydropower Turbine Market, by Application

10.1.6. North America Hydropower Turbine Market, by End-Use Sector

10.2. South America

10.2.1. South America Hydropower Turbine Market, 2024-2032

10.2.2. South America Hydropower Turbine Market, by Type

10.2.3. South America Hydropower Turbine Market, by Capacity

10.2.4. South America Hydropower Turbine Market, by Head Type

10.2.5. South America Hydropower Turbine Market, by Application

10.2.6. South America Hydropower Turbine Market, by End-Use Sector

10.3. Europe

10.3.1. Europe Hydropower Turbine Market, 2024-2032

10.3.2. Europe Hydropower Turbine Market, by Type

10.3.3. Europe Hydropower Turbine Market, by Capacity

10.3.4. Europe Hydropower Turbine Market, by Head Type

10.3.5. Europe Hydropower Turbine Market, by Application

10.3.6. Europe Hydropower Turbine Market, by End-Use Sector

10.4. Asia-Pacific

10.4.1. APAC Hydropower Turbine Market, 2024-2032

10.4.2. APAC Hydropower Turbine Market, by Type

10.4.3. APAC Hydropower Turbine Market, by Capacity

10.4.4. APAC Hydropower Turbine Market, by Head Type

10.4.5. APAC Hydropower Turbine Market, by Application

10.4.6. APAC Hydropower Turbine Market, by End-Use Sector

10.5. Middle East & Africa

10.5.1. MEA Hydropower Turbine Market, 2024-2032

10.5.2. MEA Hydropower Turbine Market, by Type

10.5.3. MEA Hydropower Turbine Market, by Capacity

10.5.4. MEA Hydropower Turbine Market, by Head Type

10.5.5. MEA Hydropower Turbine Market, by Application

10.5.6. MEA Hydropower Turbine Market, by End-Use Sector

11. Market Breakdown – by Country

11.1. Australia

11.2. Brunei

11.3. Cambodia

11.4. Indonesia

11.5. Japan

11.6. Korea, Republic of

11.7. Laos

11.8. Malaysia

11.9. Myanmar

11.10. New Caladonia

11.11. New Zealand

11.12. Philippines

11.13. Singapore

11.14. Taiwan

11.15. Thailand

11.16. Vietnam

11.17. China

11.18. Hong Kong

11.19. Bangladesh

11.20. India

11.21. Pakistan

11.22. Canada

11.23. Costa Rica

11.24. Dominician Republic

11.25. Martinique

11.26. Puerto Rico

11.27. Trinidad and Tobago

11.28. United States

11.29. Austria

11.30. Belgium

11.31. Bulgaria

11.32. Croatia

11.33. Czech Republic

11.34. Denmark

11.35. Estonia

11.36. Finland

11.37. France

11.38. Germany

11.39. Greece

11.40. Hungary

11.41. Ireland

11.42. Israel

11.43. Italy

11.44. Lithuania

11.45. Luxembourg

11.46. Netherlands

11.47. Norway

11.48. Poland

11.49. Portugal

11.50. Romania

11.51. Serbia

11.52. Slovakia

11.53. Slovenia

11.54. Spain

11.55. Sweden

11.56. Switzerland

11.57. Ukraine

11.58. United Kingdom

11.59. Argentina

11.60. Bolivia

11.61. Brazil

11.62. Chile

11.63. Colombia

11.64. Guatemala

11.65. Mexico

11.66. Peru

11.67. Suriname

11.68. Uruguay

11.69. Venezuela

11.70. Algeria

11.71. Bahrain

11.72. Egypt

11.73. Iraq

11.74. Jordan

11.75. Kuwait

11.76. Libya

11.77. Morocco

11.78. Oman

11.79. Qatar

11.80. Saudi Arabia

11.81. Tunisia

11.82. Turkey

11.83. United Arab Emirates

11.84. Yemen

11.85. Kazakhstan

11.86. Kyrgyzstan

11.87. Russia

11.88. Tajikistan

11.89. Turkmenistan

11.90. Uzbekistan

11.91. Angola

11.92. Cameroon

11.93. Chad

11.94. Congo

11.95. Gabon

11.96. Ghana

11.97. Kenya

11.98. Mozambique

11.99. Nigeria

11.100. South Africa

12. Competitive Landscape

12.1. Company Market Positioning

12.2. Company Geographical Presence Analysis

12.3. Market Revenue Share Analysis (%), by Leading Players

13. Company Profiles

Company Overview

Financial Performance

Product Benchmarking

Recent Developments

1. ANDRITZ

2. BHEL

3. Dongfang Electric Corporation

4. GE Vernova

5. Gilkes

6. GUGLER Water Turbines

7. Litostroj Power

8. Mitsubishi Heavy Industries

9. Natel Energy

10.Siemens Energy

11.Toshiba

12.Voith