Global Construction Equipment Telematics Market 2025-2032

September 17, 2025Global Life Science Analytics Market 2025-2032

September 24, 2025

Global Real-World Data (RWD) Market 2025-2032

$2695 – $4195

The global Real-World Data (RWD) and Real-World Evidence (RWE) market is undergoing a significant transformation within the healthcare and life sciences sectors. This market is centered on leveraging routinely collected health information from diverse sources outside traditional clinical trials, such as electronic health records, claims data, and patient registries. The insights derived, known as Real-World Evidence, are becoming increasingly crucial for understanding disease patterns, treatment effectiveness, and drug safety in authentic clinical settings.

| Single User | PDF Report, PDF Report + Dashboard (Multi-Users Access), PDF Report + Dashboard (Single User Access) |

|---|

Report Summary

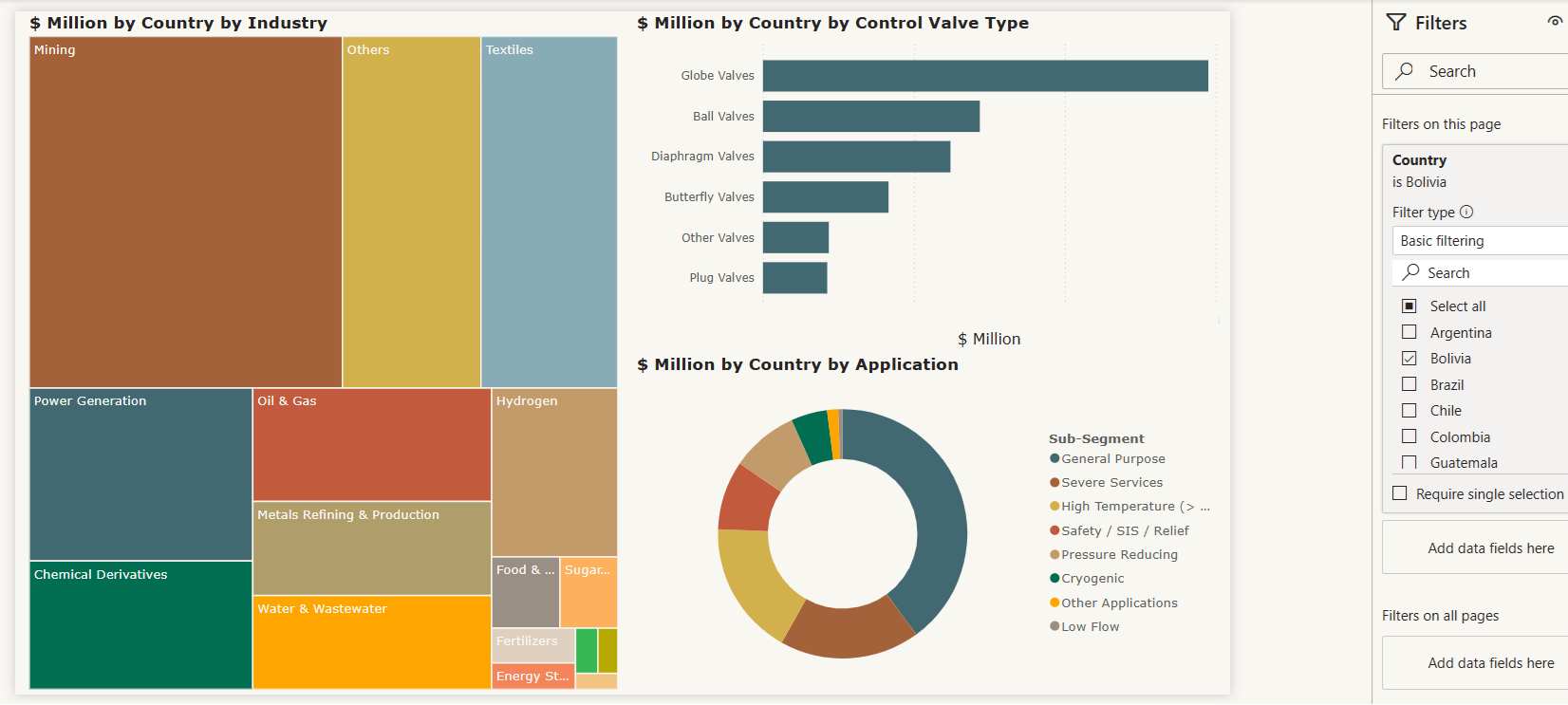

Revolutionize the way you engage with data through our cutting-edge interactive dashboard(Click to enlarge)

- The global Real-World Data (RWD) and Real-World Evidence (RWE) market is undergoing a significant transformation within the healthcare and life sciences sectors. This market is centered on leveraging routinely collected health information from diverse sources outside traditional clinical trials, such as electronic health records, claims data, and patient registries. The insights derived, known as Real-World Evidence, are becoming increasingly crucial for understanding disease patterns, treatment effectiveness, and drug safety in authentic clinical settings.

- The market’s expansion is driven by a confluence of factors. Regulatory bodies worldwide are increasingly recognizing the value of RWE in supporting drug approvals, label expansions, and post-market surveillance. Concurrently, the healthcare industry’s shift towards value-based care and personalized medicine fuels a demand for evidence that reflects real-world patient outcomes and economic impact. Furthermore, advancements in digital health technologies, including widespread EHR adoption and the rise of wearable devices, are generating an unprecedented volume of accessible health data.

- While the market’s trajectory is strongly upward, it faces inherent challenges. Data quality, fragmentation across disparate sources, and interoperability issues remain key hurdles. Stringent data privacy regulations also necessitate robust de-identification and security measures. Despite these complexities, the opportunities for innovation are immense, particularly in developing advanced analytics, artificial intelligence, and machine learning solutions to extract meaningful insights from vast datasets. Collaborative efforts among industry stakeholders, technology providers, and regulatory bodies are pivotal to unlocking the full potential of RWD in revolutionizing healthcare decision-making globally.

- North America stands as the leading region in the global Real-World Data (RWD) and Real-World Evidence (RWE) market, commanding the largest share of revenue. This dominant position is largely fueled by the region’s well-established healthcare infrastructure, rapid adoption of digital health technologies, and a regulatory environment that actively supports the use of real-world insights. The extensive use of electronic health records and a strong commitment to health technology innovation contribute significantly to the volume and accessibility of RWD.

- The market in North America is experiencing substantial growth, driven by key factors such as a supportive regulatory landscape, particularly within the United States. Regulatory bodies are increasingly integrating RWE into decision-making processes for drug approvals, new indications, and post-market safety surveillance, which boosts industry confidence and investment. High research and development expenditures by pharmaceutical and medical device companies further propel the demand for RWD to optimize clinical trials and evaluate product performance. The ongoing shift towards value-based care also underscores the importance of RWE in demonstrating the effectiveness and economic value of medical interventions.

- Despite its leadership, North America faces challenges including data fragmentation, issues with interoperability across diverse healthcare systems, and the need for consistent data quality and standardization. Strict data privacy regulations, while essential, add layers of complexity to data access and utilization. Nevertheless, the region’s strong ecosystem of key players, strategic collaborations, and a growing emphasis on integrating genomic data for precision medicine ensure its continued prominence in the RWD/RWE landscape.

- The United States constitutes the vast majority of the North American RWD market and acts as a global frontrunner in this domain. Its unique healthcare system and regulatory framework significantly shape the RWD landscape, making it a critical hub for innovation and adoption. The intricate blend of public and private insurance systems, coupled with a wide network of healthcare providers, generates an enormous volume of diverse RWD, notably from claims and electronic health records.

- A primary driver for the U.S. market is the progressive stance of its regulatory bodies, particularly the FDA. The FDA has been at the forefront of embracing RWE, issuing clear guidelines and actively utilizing real-world data for drug safety monitoring and, increasingly, for regulatory submissions. This proactive approach provides clarity and incentives for companies to invest in RWD initiatives. The presence of the world’s largest pharmaceutical and medical device companies, which are major consumers of RWD across all stages of product development and commercialization, further accelerates market expansion.

Table of Content

1. Report Scope

1.1. Market Segmentation and scope

1.2. Regional Scope

1.3. Estimates and forecast timeline

2. Market Research Methodology

2.1. Research methodology and design

2.2. Sample selection

2.3. Reliability and validity

3. Executive Summary

4. Market Analysis

4.1. Market size and growth rates

4.2. Market growth drivers, market dynamics and trends

4.3. Market scenarios and opportunity forecasts

4.4. Market constraints and challenges

4.5. Industry value chain analysis

4.6. Industry analysis – Porter’s

4.6.1. Threat of new entrants

4.6.2. Bargaining power of suppliers

4.6.3. Bargaining power of buyers

4.6.4. Threat of substitutes

4.6.5. Competitive rivalry

4.7. PEST analysis

4.7.1. Political/legal landscape

4.7.2. Economic landscape

4.7.3. Social landscape

4.7.4. Technological landscape

5. Market Breakdown – by Component

5.1. Introduction

5.2. Services

5.2.1. Consulting Services

5.2.2. Data Analytics Services

5.2.3. Real-World Evidence (RWE) Generation Services

5.2.4. Other Support Services

5.3. Data Sets

5.3.1. Electronic Health Records (EHRs)/Clinical Setting Data

5.3.2. Claims and Billing Data

5.3.3. Pharmacy Data

5.3.4. Patient-Reported Outcomes (PROs) Data

5.3.5. Patient Registries Data

5.3.6. Wearable Devices/Digital Health Data

5.3.7. Genomic Data

5.3.8. Other Data Sets

6. Market Breakdown – by Application

6.1. Introduction

6.2. Drug Development and Approvals

6.2.1. Clinical Trial Design and Optimization

6.2.2. Patient Recruitment and Retention

6.2.3. Post-Market Surveillance and Drug Safety Monitoring

6.2.4. Regulatory Submissions

6.3. Medical Device Development and Approvals

6.4. Market Access and Reimbursement/Coverage Decisions:

6.5. Clinical Research

6.5.1. Comparative Effectiveness Research

6.5.2. Observational Studies

6.5.3. Pragmatic Clinical Trials

6.6. Healthcare Decision-Making

6.6.1. Clinical Practice Guidelines

6.6.2. Public Health Policy

6.6.3. Healthcare Quality Improvement

6.7. Other Applications

7. Market Breakdown – by Deployment Model (for RWE solutions)

7.1. Introduction

7.2. On-premises

7.3. Cloud-based

8. Market Breakdown – by End-User

8.1. Introduction

8.2. Pharmaceutical and Medical Device Companies

8.3. Healthcare Payers

8.4. Healthcare Providers

8.5. Other End Users

9. Market Breakdown – by Geography

9.1. North America

9.1.1. North America RWD Market, 2025-2032

9.1.2. North America RWD Market, by Component

9.1.3. North America RWD Market, by Application

9.1.4. North America RWD Market, by Deployment Model

9.1.5. North America RWD Market, by End-User

9.1.6. North America RWD Market, by Country

9.1.6.1. U.S.

9.1.6.2. Canada

9.1.6.3. Mexico

9.2. South America

9.2.1. South America RWD Market, 2025-2032

9.2.2. South America RWD Market, by Component

9.2.3. South America RWD Market, by Application

9.2.4. South America RWD Market, by Deployment Model

9.2.5. South America RWD Market, by End-User

9.2.6. South America RWD Market, by Country

9.2.6.1. Brazil

9.2.6.2. Argentina

9.2.6.3. Others

9.3. Europe

9.3.1. Europe RWD Market, 2025-2032

9.3.2. Europe RWD Market, by Component

9.3.3. Europe RWD Market, by Application

9.3.4. Europe RWD Market, by Deployment Model

9.3.5. Europe RWD Market, by End-User

9.3.6. Europe RWD Market, by Country

9.3.6.1. Germany

9.3.6.2. France

9.3.6.3. U.K.

9.3.6.4. Italy

9.3.6.5. Spain

9.3.6.6. Sweden

9.3.6.7. Belgium

9.3.6.8. Denmark

9.3.6.9. Austria

9.3.6.10. Norway

9.3.6.11. Switzerland

9.3.6.12. Netherlands

9.3.6.13. Russia

9.3.6.14. Others

9.4. Asia-Pacific

9.4.1. APAC RWD Market, 2025-2032

9.4.2. APAC RWD Market, by Component

9.4.3. APAC RWD Market, by Application

9.4.4. APAC RWD Market, by Deployment Model

9.4.5. APAC RWD Market, by End-User

9.4.6. APAC RWD Market, by Country

9.4.6.1. China

9.4.6.2. Japan

9.4.6.3. South Korea

9.4.6.4. India

9.4.6.5. Australia

9.4.6.6. Others

9.5. Middle East & Africa

9.5.1. MEA RWD Market, 2025-2032

9.5.2. MEA RWD Market, by Component

9.5.3. MEA RWD Market, by Application

9.5.4. MEA RWD Market, by Deployment Model

9.5.5. MEA RWD Market, by End-User

9.5.6. MEA RWD Market, by Country

9.5.6.1. Saudi Arabia

9.5.6.2. UAE

9.5.6.3. Israel

9.5.6.4. Others

10. Competitive Landscape

10.1. Global Revenue Share Analysis (%), by Leading Players

10.2. North America Revenue Share Analysis (%), by Leading Players

10.3. Europe Revenue Share Analysis (%), by Leading Players

10.4. APAC Revenue Share Analysis (%), by Leading Players

10.5. South America Revenue Share Analysis (%), by Leading Players

10.6. MEA Revenue Share Analysis (%), by Leading Players

10.7. Key Companies List

10.7.1. Aetion Inc.

10.7.2. Cegedim Health Data

10.7.3. Clinigen Group plc

10.7.4. Cognizant Technology Solutions Corp.

10.7.5. Datavant

10.7.6. Flatiron Health (a Roche company)

10.7.7. HealthVerity Inc.

10.7.8. ICON plc (includes PRA Health Sciences)

10.7.9. IQVIA Holdings Inc.

10.7.10. Medpace Holdings, Inc.

10.7.11. Merative (formerly IBM Watson Health)

10.7.12. OM1

10.7.13. Optum Inc. (UnitedHealth Group)

10.7.14. Oracle Corporation (includes Cerner)

10.7.15. Palantir

10.7.16. Parexel International Corporation

10.7.17. PPD, Inc. (Acquired by Thermo Fisher Scientific, Inc.)

10.7.18. SAS Institute Inc.

10.7.19. Syneos Health Inc.

10.7.20. Tempus Labs Inc.