Global Life Science Analytics Market 2025-2032

September 24, 2025Global Construction Prime Power Generators Market 2025-2032

October 1, 2025

Global Anti-Surge Valves Market 2025-2032

$2695 – $4195

The global anti-surge valves market is a vital segment within industrial process control, dedicated to safeguarding critical rotating equipment, primarily compressors, from destructive surge conditions. These specialized valves are engineered for rapid response and precise control, ensuring operational stability, enhancing safety, and preventing costly downtime in demanding industrial environments. Their indispensability in protecting high-value assets and maintaining continuous operations is a key driver for market expansion.

| Single User | PDF Report, PDF Report + Dashboard (Multi-Users Access), PDF Report + Dashboard (Single User Access) |

|---|

Report Summary

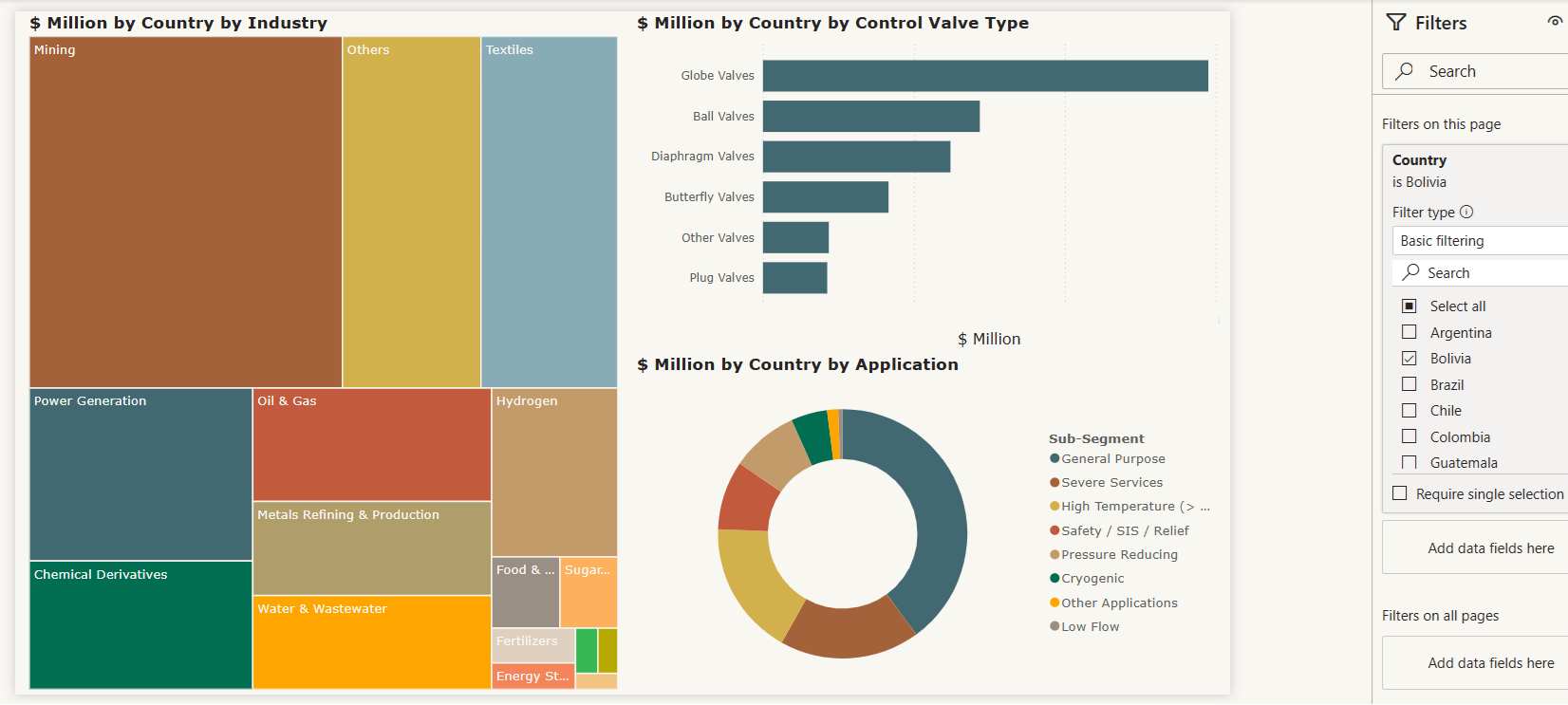

Revolutionize the way you engage with data through our cutting-edge interactive dashboard(Click to enlarge)

- The global anti-surge valves market is a vital segment within industrial process control, dedicated to safeguarding critical rotating equipment, primarily compressors, from destructive surge conditions. These specialized valves are engineered for rapid response and precise control, ensuring operational stability, enhancing safety, and preventing costly downtime in demanding industrial environments. Their indispensability in protecting high-value assets and maintaining continuous operations is a key driver for market expansion.

- The market’s growth is consistently propelled by stringent safety regulations across industries, a rising global emphasis on optimizing energy efficiency, and the continuous expansion and modernization of industrial infrastructure, particularly in developing economies. Technological advancements are also playing a crucial role, with increasing integration of smart valve solutions, advanced diagnostics, and automation capabilities. These innovations enhance valve performance, enable predictive maintenance, and facilitate seamless integration into complex control systems.

- Key sectors driving demand for anti-surge valves include the vast Oil & Gas industry (encompassing natural gas boosting, transmission, LNG, subsea extraction, GTL, and offshore platforms), Refineries (especially in critical FCC Units), Chemical & Petrochemical Processing, and Power Generation. The market is highly competitive, featuring established global players who focus on product differentiation, technological leadership, and strategic partnerships to meet the evolving and diverse requirements of these critical industrial applications.

- Globe-style Anti-Surge Valves (Angle Body and Straight Through) continue to be a foundational segment. While already widely adopted for their robust control and proven reliability, the trend here focuses on optimization of internal trim designs. Manufacturers are developing multi-stage and low-noise trims to better manage high-pressure drops, reduce acoustic emissions, and minimize vibration, which are critical concerns in anti-surge applications. Innovations in materials and advanced computational fluid dynamics (CFD) are enabling higher flow coefficients within standard valve body dimensions, allowing for smaller valve sizes for the same capacity and potentially reducing station footprints.

- Axial Flow Anti-Surge Valves are seeing a trend towards even faster response times and higher capacities, catering to the increasing size and performance of modern turbocompressors, particularly in large-scale oil & gas (e.g., LNG) and power generation projects. A notable trend for these high-performance valves is the development of electrically actuated fail-safe solutions. Traditionally dominated by hydraulics for speed, advancements in electric actuator technology are enabling comparable opening times with the added benefits of digital integration, lower power consumption, and reduced environmental impact (zero emissions from hydraulic fluid leaks), making them an attractive option for certain critical applications.

- Rotary Anti-Surge Valves (including T-Ball valves) are gaining significant traction, with a strong trend towards leveraging their inherent advantages. These valves are increasingly being optimized for high turndown ratios and superior flow capacity compared to traditional globe-style valves, allowing a single valve to handle a wider range of operating conditions. The “self-cleaning” design of certain rotary valves is also a key trend, reducing maintenance and preventing buildup, especially in applications with contaminated gas. Furthermore, their compact design allows for a smaller station footprint and can facilitate unique installations, such as buried service, which offers additional noise reduction benefits

- North America represents a significant and dynamic market for anti-surge valves, driven by its extensive industrial base, robust energy sector, and a strong focus on operational safety and efficiency. The region’s vast oil and gas industry, encompassing substantial shale oil and gas production, extensive pipeline networks, and significant refining and petrochemical capacities, creates a consistent and high demand for anti-surge solutions. Additionally, ongoing investments in power generation, including natural gas-fired plants, and modernization initiatives across various manufacturing sectors further contribute to the market’s strength. The stringent regulatory environment in both the U.S. and Canada, emphasizing industrial safety and environmental compliance, mandates the use of reliable anti-surge systems to protect critical infrastructure and prevent hazardous incidents.

- The North American market is also characterized by a strong inclination towards technological adoption and advanced automation. This translates into a growing demand for smart anti-surge valves equipped with digital positioners, integrated control systems, and IoT capabilities, enabling real-time monitoring, predictive maintenance, and optimized compressor performance. While new project developments, particularly in the oil and gas midstream and downstream sectors, drive fresh demand, the region also presents substantial opportunities for retrofit and upgrade projects in its mature industrial facilities. The presence of leading global valve manufacturers and control system providers in North America further fosters innovation and ensures a competitive landscape, with a focus on delivering high-performance, durable, and digitally integrated anti-surge valve solutions.

- The European anti-surge valve market is characterized by intense competition, dominated by well-established global players such as Emerson (Fisher), Flowserve, IMI Critical Engineering, SAMSON, and Metso (Neles). These industry leaders leverage their extensive portfolios, deep technical expertise, and robust regional sales and service networks to maintain strong market positions. Competition hinges not only on the core performance and reliability of the anti-surge valves but also on the ability to provide comprehensive, integrated solutions, including advanced control systems and robust after-sales support. This holistic approach is critical for success in Europe’s mature industrial sectors, including oil & gas, chemical processing, power generation, and air separation, where operational reliability and safety are paramount.

- Beyond product features, the competitive landscape in Europe is increasingly shaped by technological innovation and adherence to stringent regional regulations. Manufacturers are heavily investing in research and development to deliver anti-surge valves with enhanced digital capabilities, faster response times, reduced energy consumption, and lower noise emissions, aligning with Industry 4.0 and sustainability goals. Companies that can offer high-performance, digitally integrated, and compliant solutions, coupled with strong local technical support and efficient supply chains, gain a significant competitive advantage. Strategic alliances with original equipment manufacturers (OEMs) of compressors and major engineering, procurement, and construction (EPC) firms are also crucial for securing large-scale projects and expanding market footprint across the continent.

Table of Content

1. Report Scope

1.1. Market Segmentation and scope

1.2. Regional Scope

1.3. Estimates and forecast timeline

2. Market Research Methodology

2.1. Research methodology and design

2.2. Sample selection

2.3. Reliability and validity

3. Executive Summary

4. Market Analysis

4.1. Market size and growth rates

4.2. Market growth drivers, market dynamics and trends

4.3. Market scenarios and opportunity forecasts

4.4. Market constraints and challenges

4.5. Industry value chain analysis

4.6. Industry analysis – Porter’s

4.6.1. Threat of new entrants

4.6.2. Bargaining power of suppliers

4.6.3. Bargaining power of buyers

4.6.4. Threat of substitutes

4.6.5. Competitive rivalry

4.7. PEST analysis

4.7.1. Political/legal landscape

4.7.2. Economic landscape

4.7.3. Social landscape

4.7.4. Technological landscape

5. Market Breakdown – by Type

5.1. Introduction

5.2. Angle Body Anti-Surge Valves

5.3. Straight Through Anti-Surge Valves

5.4. Axial Flow Anti-Surge Valves

5.5. Rotary (Ball/Eccentric Plug) Anti-Surge Valves

6. Market Breakdown – by Actuation

6.1. Introduction

6.2. Pneumatic Actuated Anti-Surge Valves

6.3. Electric Actuated Anti-Surge Valves

6.4. Hydraulic Actuated Anti-Surge Valves

7. Market Breakdown – by Component

7.1. Introduction

7.2. Valve Body

7.3. Actuators

7.4. Positioners

7.5. Controller/Control Systems

7.6. Other Components

8. Market Breakdown – by Application

8.1. Introduction

8.2. Centrifugal Compressors

8.3. Axial Compressors

9. Market Breakdown – by End-Use Industry

9.1. Introduction

9.2. Oil & Gas (Upstream & Midstream)

9.2.1. Natural Gas Booster Stations

9.2.2. Gas Transmission Pipelines

9.2.3. LNG Liquefaction Plants

9.2.4. Subsea Extraction

9.2.5. Gas to Liquids (GTL)

9.2.6. Offshore Platforms

9.3. Refineries

9.3.1. FCC (Fluid Catalytic Cracking) Units

9.3.2. Other Refinery Compressor Systems (e.g., Hydrocracking, Reforming)

9.4. Chemical & Petrochemical Processing

9.4.1. Petrochemical Plants

9.4.2. Other Chemical Plant Compressor Systems

9.5. Power Generation

9.6. Air Separation Units (ASU)

9.7. Other Industrial

10. Market Breakdown – by Geography

10.1. North America

10.1.1. North America Anti-Surge Valves Market, 2025-2032

10.1.2. North America Anti-Surge Valves Market, by Type

10.1.3. North America Anti-Surge Valves Market, by Actuation

10.1.4. North America Anti-Surge Valves Market, by Component

10.1.5. North America Anti-Surge Valves Market, by Application

10.1.6. North America Anti-Surge Valves Market, by End-Use Industry

10.1.7. North America Anti-Surge Valves Market, by Country

10.1.7.1. U.S.

10.1.7.2. Canada

10.1.7.3. Mexico

10.2. South America

10.2.1. South America Anti-Surge Valves Market, 2025-2032

10.2.2. South America Anti-Surge Valves Market, by Type

10.2.3. South America Anti-Surge Valves Market, by Actuation

10.2.4. South America Anti-Surge Valves Market, by Component

10.2.5. South America Anti-Surge Valves Market, by Application

10.2.6. South America Anti-Surge Valves Market, by End-Use Industry

10.2.7. South America Anti-Surge Valves Market, by Country

10.2.7.1. Brazil

10.2.7.2. Argentina

10.2.7.3. Others

10.3. Europe

10.3.1. Europe Anti-Surge Valves Market, 2025-2032

10.3.2. Europe Anti-Surge Valves Market, by Type

10.3.3. Europe Anti-Surge Valves Market, by Actuation

10.3.4. Europe Anti-Surge Valves Market, by Component

10.3.5. Europe Anti-Surge Valves Market, by Application

10.3.6. Europe Anti-Surge Valves Market, by End-Use Industry

10.3.7. Europe Anti-Surge Valves Market, by Country

10.3.7.1. Germany

10.3.7.2. France

10.3.7.3. U.K.

10.3.7.4. Italy

10.3.7.5. Spain

10.3.7.6. Sweden

10.3.7.7. Belgium

10.3.7.8. Denmark

10.3.7.9. Austria

10.3.7.10. Norway

10.3.7.11. Switzerland

10.3.7.12. Netherlands

10.3.7.13. Poland

10.3.7.14. Russia

10.3.7.15. Others

10.4. Asia-Pacific

10.4.1. APAC Anti-Surge Valves Market, 2025-2032

10.4.2. APAC Anti-Surge Valves Market, by Type

10.4.3. APAC Anti-Surge Valves Market, by Actuation

10.4.4. APAC Anti-Surge Valves Market, by Component

10.4.5. APAC Anti-Surge Valves Market, by Application

10.4.6. APAC Anti-Surge Valves Market, by End-Use Industry

10.4.7. APAC Anti-Surge Valves Market, by Country

10.4.7.1. China

10.4.7.2. Japan

10.4.7.3. South Korea

10.4.7.4. India

10.4.7.5. Australia

10.4.7.6. Others

10.5. Middle East & Africa

10.5.1. MEA Anti-Surge Valves Market, 2025-2032

10.5.2. MEA Anti-Surge Valves Market, by Type

10.5.3. MEA Anti-Surge Valves Market, by Actuation

10.5.4. MEA Anti-Surge Valves Market, by Component

10.5.5. MEA Anti-Surge Valves Market, by Application

10.5.6. MEA Anti-Surge Valves Market, by End-Use Industry

10.5.7. MEA Anti-Surge Valves Market, by Country

10.5.7.1. UAE

10.5.7.2. Iraq

10.5.7.3. Saudi Arabia

10.5.7.4. Kuwait

10.5.7.5. Israel

10.5.7.6. South Africa

10.5.7.7. Others

11. Competitive Landscape

11.1. Global Revenue Share Analysis (%), by Leading Players

11.2. North America Revenue Share Analysis (%), by Leading Players

11.3. Europe Revenue Share Analysis (%), by Leading Players

11.4. APAC Revenue Share Analysis (%), by Leading Players

11.5. South America Revenue Share Analysis (%), by Leading Players

11.6. MEA Revenue Share Analysis (%), by Leading Players

11.7. Key Companies List

11.7.1. ARI-Armaturen

11.7.2. AviComp Controls GmbH

11.7.3. Baker Hughes

11.7.4. Böhmer GmbH

11.7.5. Cameron (Schlumberger)

11.7.6. Celeros Flow Technology

11.7.7. Compressor Controls Corporation (CCC)

11.7.8. Dresser Natural Gas Solutions

11.7.9. Dutch Valve Vision

11.7.10. Emerson Electric Co.

11.7.11. Flowserve Corporation

11.7.12. IMI Critical Engineering

11.7.13. Kitz Corporation

11.7.14. KSB SE & Co. KGaA

11.7.15. Mankenberg

11.7.16. Metso (Neles)

11.7.17. MOGAS Industries, Inc.

11.7.18. Mokveld Valves B.V.

11.7.19. OMB Valves

11.7.20. Oventrop GmbH

11.7.21. SAMSON Controls Inc.

11.7.22. Suzhou Valves Co., Ltd.

11.7.23. Valve Italia

11.7.24. ValvTechnologies Inc.

11.7.25. Velan Inc.

11.7.26. Yokogawa Electric Corporation

11.7.27. Zhejiang Yongsheng Technology Co., Ltd.

11.7.28. Zwick Armaturen GmbH