Global Construction Prime Power Generators Market 2025-2032

October 1, 2025

Global biologics cdmo Market 2026-2034

$4195 – $5695

| Single User | PDF Report, PDF Report + Dashboard (Multi-Users Access), PDF Report + Dashboard (Single User Access) |

|---|

Report Summary

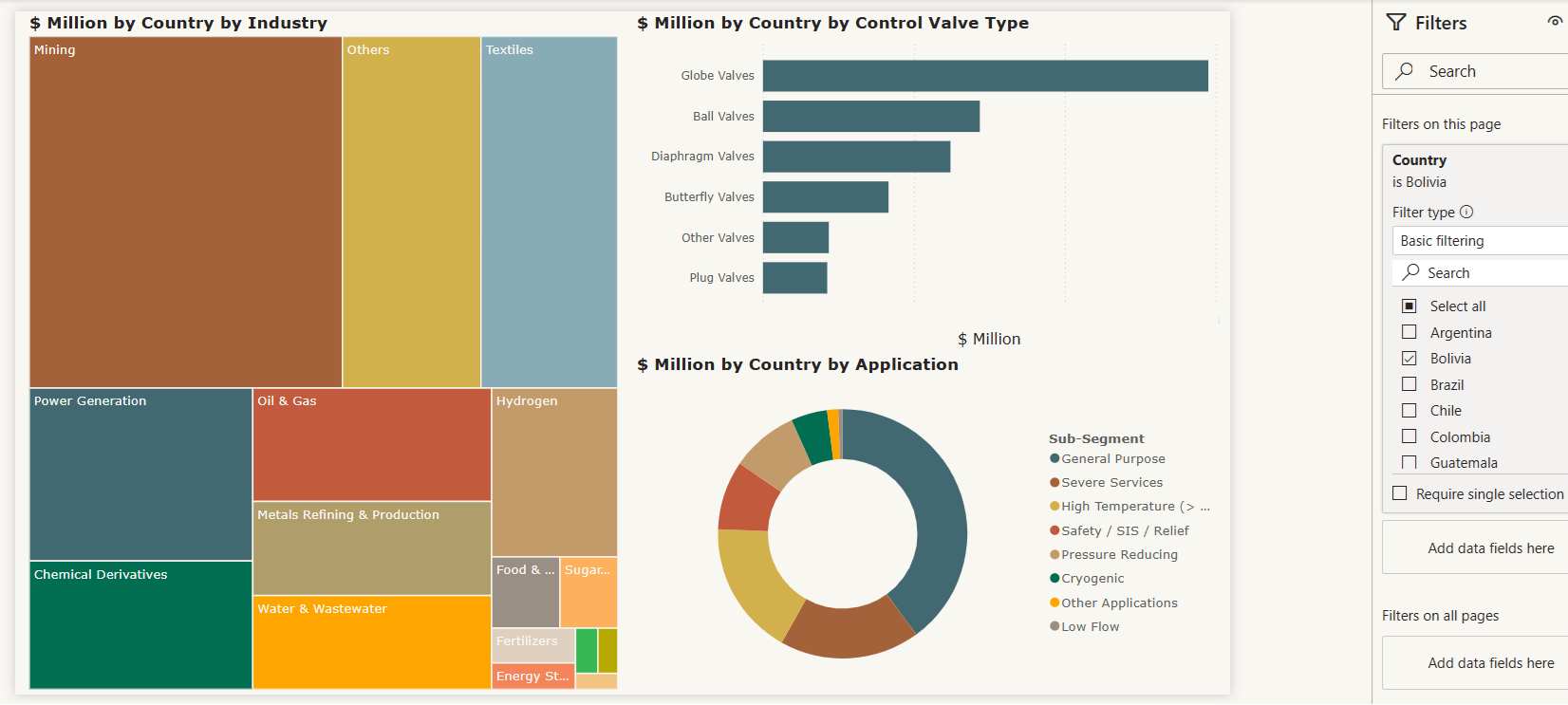

Revolutionize the way you engage with data through our cutting-edge interactive dashboard(Click to enlarge)

- The global biologics CDMO market in 2026 is defined by a strategic pivot from standardized manufacturing toward a partnership-led, high-complexity service model. As pharmaceutical portfolios increasingly migrate from traditional monoclonal antibodies toward sophisticated modalities—such as antibody-drug conjugates (ADCs), bispecifics, and GLP-1 agonists—the role of the CDMO has transitioned from a tactical capacity provider to a fundamental architect of the drug’s lifecycle. This evolution is underscored by the integration of AI-driven bioprocessing and digital twins to optimize yields and compress the “path-to-clinic,” allowing sponsors to mitigate the high capital risks associated with large-molecule development while accessing specialized technical expertise that is increasingly difficult to maintain in-house.

- Simultaneously, the market is navigating a complex geopolitical and operational landscape where supply chain resilience is a primary competitive differentiator. Heightened regulatory scrutiny and initiatives aimed at diversifying manufacturing footprints—such as the onshoring of critical biological assets—have spurred significant infrastructure investments in North America and Europe, even as Asia-Pacific matures into a sophisticated hub for high-volume commercial production. To capture value in this environment, leading CDMOs are adopting “one-stop-shop” integrated platforms that bridge the gap between early-stage development and sterile fill-finish. This consolidation of services, combined with the adoption of sustainable, single-use technologies and continuous manufacturing, ensures that providers can offer the agility required to support both the specialized needs of lean biotech firms and the global scale required by established pharmaceutical giants.

Table of Content

1. Report Scope

1.1. Market Segmentation and scope

1.2. Regional Scope

1.3. Estimates and forecast timeline

2. Market Research Methodology

2.1. Research methodology and design

2.2. Sample selection

2.3. Reliability and validity

3. Executive Summary

4. Market Analysis

4.1. Market size and growth rates

4.2. Market growth drivers, market dynamics and trends

4.3. Market scenarios and opportunity forecasts

4.4. Market constraints and challenges

4.5. Industry value chain analysis

4.6. Industry analysis – Porter’s

4.6.1. Threat of new entrants

4.6.2. Bargaining power of suppliers

4.6.3. Bargaining power of buyers

4.6.4. Threat of substitutes

4.6.5. Competitive rivalry

4.7. PEST analysis

4.7.1. Political/legal landscape

4.7.2. Economic landscape

4.7.3. Social landscape

4.7.4. Technological landscape

5. Market Breakdown – by Modality

5.1. Introduction

5.2. Monoclonal Antibodies (mAbs)

5.3. Cell and Gene Therapies (CGT)

5.4. Antibody-Drug Conjugates (ADCs)

5.5. Recombinant Proteins

5.6. Vaccines (mRNA, Viral Vector, Subunit)

5.7. Others (Peptides, Nucleic Acids)

6. Market Breakdown – by Workflow

6.1. Introduction

6.2. Clinical

6.3. Commercial

7. Market Breakdown – by Expression System

7.1. Introduction

7.2. Mammalian Systems

7.3. Microbial Systems

7.4. Others

8. Market Breakdown – by Service Type

8.1. Introduction

8.2. Contract Development (Cell Line & Process Development)

8.3. Drug Substance Manufacturing (API)

8.4. Drug Product Manufacturing (Fill-Finish)

8.5. Analytical & Quality Control Services

9. Market Breakdown – by Therapeutic Area

9.1. Introduction

9.2. Oncology

9.3. Autoimmune Diseases

9.4. Infectious Diseases

9.5. Metabolic Diseases

9.6. Cardiovascular Diseases

9.7. Neurological Diseases

9.8. Others

10. Market Breakdown – by End-Use

10.1. Introduction

10.2. Pharmaceutical Companies

10.3. Biotechnology Companies

10.4. Academic and Research Institutions

10.5. Others

11. Market Breakdown – by Geography

11.1. North America

11.1.1. North America Biologics CDMO Market, 2026-2034

11.1.2. North America Biologics CDMO Market, by Modality

11.1.3. North America Biologics CDMO Market, by Workflow

11.1.4. North America Biologics CDMO Market, by Expression System

11.1.5. North America Biologics CDMO Market, by Service Type

11.1.6. North America Biologics CDMO Market, by Therapeutic Area

11.1.7. North America Biologics CDMO Market, by End-Use

11.1.8. North America Biologics CDMO Market, by Country

11.1.8.1. U.S.

11.1.8.2. Canada

11.1.8.3. Mexico

11.2. South America

11.2.1. North America Biologics CDMO Market, by Modality

11.2.2. North America Biologics CDMO Market, by Workflow

11.2.3. North America Biologics CDMO Market, by Expression System

11.2.4. North America Biologics CDMO Market, by Service Type

11.2.5. North America Biologics CDMO Market, by Therapeutic Area

11.2.6. North America Biologics CDMO Market, by End-Use

11.2.7. North America Biologics CDMO Market, by Country

11.2.7.1. Brazil

11.2.7.2. Argentina

11.2.7.3. Others

11.3. Europe

11.3.1. North America Biologics CDMO Market, by Modality

11.3.2. North America Biologics CDMO Market, by Workflow

11.3.3. North America Biologics CDMO Market, by Expression System

11.3.4. North America Biologics CDMO Market, by Service Type

11.3.5. North America Biologics CDMO Market, by Therapeutic Area

11.3.6. North America Biologics CDMO Market, by End-Use

11.3.7. North America Biologics CDMO Market, by Country

11.3.7.1. Germany

11.3.7.2. France

11.3.7.3. U.K.

11.3.7.4. Italy

11.3.7.5. Spain

11.3.7.6. Sweden

11.3.7.7. Switzerland

11.3.7.8. Netherlands

11.3.7.9. Russia

11.3.7.10. Others

11.4. Asia-Pacific

11.4.1. North America Biologics CDMO Market, by Modality

11.4.2. North America Biologics CDMO Market, by Workflow

11.4.3. North America Biologics CDMO Market, by Expression System

11.4.4. North America Biologics CDMO Market, by Service Type

11.4.5. North America Biologics CDMO Market, by Therapeutic Area

11.4.6. North America Biologics CDMO Market, by End-Use

11.4.7. North America Biologics CDMO Market, by Country

11.4.7.1. China

11.4.7.2. Japan

11.4.7.3. South Korea

11.4.7.4. India

11.4.7.5. Australia

11.4.7.6. Others

11.5. Middle East & Africa

11.5.1. North America Biologics CDMO Market, by Modality

11.5.2. North America Biologics CDMO Market, by Workflow

11.5.3. North America Biologics CDMO Market, by Expression System

11.5.4. North America Biologics CDMO Market, by Service Type

11.5.5. North America Biologics CDMO Market, by Therapeutic Area

11.5.6. North America Biologics CDMO Market, by End-Use

11.5.7. North America Biologics CDMO Market, by Country

11.5.7.1. Saudi Arabia

11.5.7.2. UAE

11.5.7.3. Israel

11.5.7.4. South Africa

11.5.7.5. Others

12. Competitive Landscape

12.1. Market Competitive Scope & Methodology

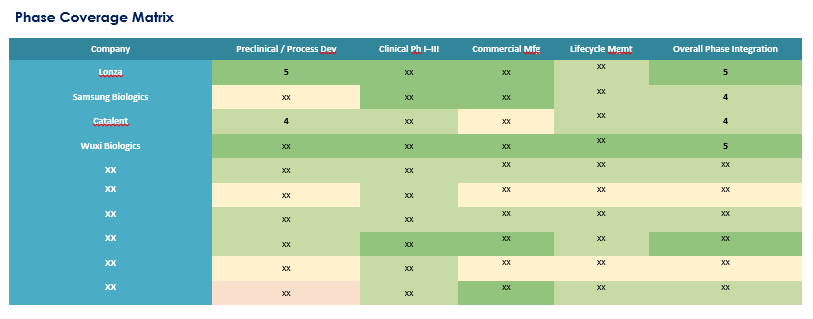

12.2. Phase-Based Coverage Landscape

12.3. Phase Coverage Matrix

12.4. Capability Benchmarking

12.5. Capability × Region Overlay

12.6. Aggregated Competitive Heatmap

12.7. Portfolio Breadth vs Depth Analysis

12.8. Phase Transition Continuity Assessment

12.9. Strategic Positioning Summary

12.10. Quantitative Competitive Scorecard

12.11. White-Space Opportunity Map

12.12. Competitive Implications & Strategic Takeaways

12.13. Global Revenue Share Analysis (%), by Leading Players

12.14. North America Revenue Share Analysis (%), by Leading Players

12.15. Europe Revenue Share Analysis (%), by Leading Players

12.16. APAC Revenue Share Analysis (%), by Leading Players

12.17. South America Revenue Share Analysis (%), by Leading Players

12.18. MEA Revenue Share Analysis (%), by Leading Players

12.19. Competitive Universe Overview

12.19.1. 3P Biopharmaceuticals

12.19.2. 53Biologics

12.19.3. AbbVie Contract Manufacturing

12.19.4. Adragos Pharma

12.19.5. AGC Biologics

12.19.6. Aenova Group

12.19.7. Ajinomoto Bio-Pharma Services (Althea)

12.19.8. Almac Group

12.19.9. Aragen Bioscience

12.19.10. Axplora (incl. Novasep)

12.19.11. Bachem

12.19.12. Baxter BioPharma Solutions

12.19.13. Biomay

12.19.14. Biovian Oy

12.19.15. Binex Co., Ltd.

12.19.16. BiosanaPharma

12.19.17. Boehringer Ingelheim International GmbH (BioXcellence)

12.19.18. Cambrex (Emerging in biologics)

12.19.19. Catalent Biologics

12.19.20. Cenexi – Laboratoires Thissen SA

12.19.21. Celonic Group

12.19.22. Charles River Laboratories (Biologics CDMO services)

12.19.23. Cobra Biologics (Charles River)

12.19.24. CordenPharma

12.19.25. Curia Global (formerly AMRI)

12.19.26. Cytiva (bioprocess/biologics services)

12.19.27. Delpharm

12.19.28. Emergent BioSolutions (CDMO division)

12.19.29. Eurofins CDMO

12.19.30. Evonik (biologics/advanced drug delivery CDMO)

12.19.31. Famar SA

12.19.32. Fareva

12.19.33. FUJIFILM Diosynth Biotechnologies

12.19.34. IDT Biologika GmbH

12.19.35. Jubilant Biosys / KBI Biopharma

12.19.36. Lonza Group AG

12.19.37. Merck KGaA / MilliporeSigma CDMO

12.19.38. MGI / Mabion (EU biologics CDMOs)

12.19.39. Minaris Regenerative Medicine

12.19.40. Novartis / Sandoz Contract Manufacturing

12.19.41. Oxford Biomedica

12.19.42. Patheon (Thermo Fisher Scientific)

12.19.43. Pelican BioTherapeutics

12.19.44. Pfizer CentreOne

12.19.45. Pierre Fabre CDMO

12.19.46. Polpharma Biologics

12.19.47. Polymun Scientific

12.19.48. Porton Pharma Solutions (Porton Bio)

12.19.49. Prothya Biosolutions

12.19.50. Recipharm AB

12.19.51. Rentschler Biopharma SE

12.19.52. Richter Biologics

12.19.53. Samsung Biologics

12.19.54. Samsung Bioepis (contract operations subset)

12.19.55. Siegfried Holding AG

12.19.56. Thermo Fisher Scientific (Patheon)

12.19.57. Toho / Kyowa Kirin (biologics CDMO units)

12.19.58. Vetter Pharma International

12.19.59. WuXi Biologics (incl. EU sites in IE & DE)

12.19.60. Zelluna / other emerging EU CGT CDMOs