Global Hydropower Turbine Market 2025-2032

May 28, 2025Global Real-World Data (RWD) Market 2025-2032

September 17, 2025

Global Construction Equipment Telematics Market 2025-2032

$2695 – $4195

The global construction equipment telematics market is experiencing a period of significant expansion, propelled by the universal demand for enhanced operational efficiency, rigorous safety compliance, and sustainable practices across construction projects. Telematics solutions provide invaluable real-time data on machinery performance, location, and utilization, enabling construction firms to optimize resource allocation, minimize costly downtime, and implement proactive maintenance strategies. This technological integration is becoming fundamental for organizations worldwide striving to maximize productivity and effectively manage rising operational costs in an increasingly competitive landscape.

| Single User | PDF Report, PDF Report + Dashboard (Multi-Users Access), PDF Report + Dashboard (Single User Access) |

|---|

Report Summary

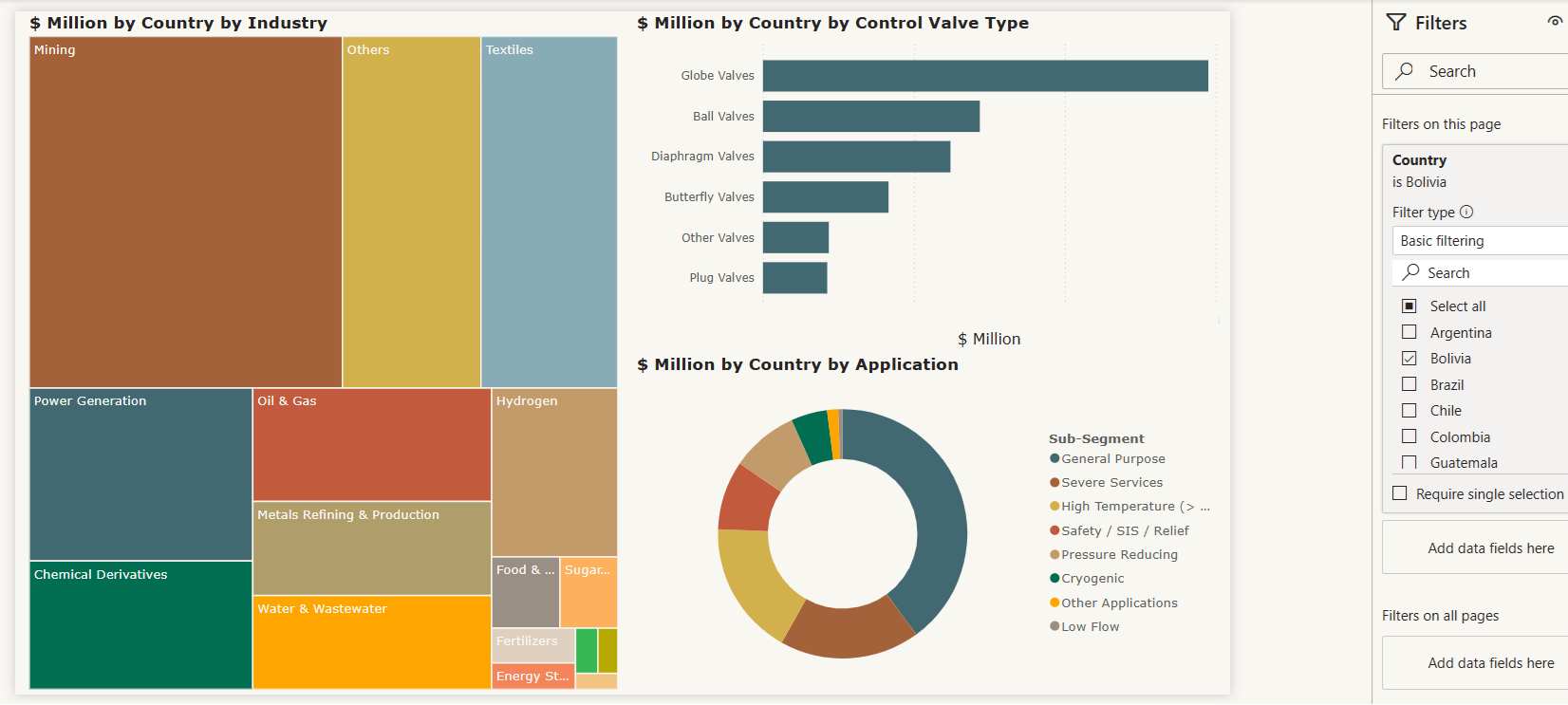

Revolutionize the way you engage with data through our cutting-edge interactive dashboard(Click to enlarge)

- The global construction equipment telematics market is experiencing a period of significant expansion, propelled by the universal demand for enhanced operational efficiency, rigorous safety compliance, and sustainable practices across construction projects. Telematics solutions provide invaluable real-time data on machinery performance, location, and utilization, enabling construction firms to optimize resource allocation, minimize costly downtime, and implement proactive maintenance strategies. This technological integration is becoming fundamental for organizations worldwide striving to maximize productivity and effectively manage rising operational costs in an increasingly competitive landscape.

- A primary driver behind this global growth is the accelerating pace of infrastructure development and urbanization across both established and emerging markets, coupled with an overarching industry shift towards digital transformation. Companies are increasingly leveraging telematics to gain actionable insights into fleet management, monitor fuel consumption for environmental targets, and enhance asset security against theft and unauthorized use. Furthermore, evolving regulatory frameworks globally, which increasingly emphasize workplace safety and environmental impact, are compelling broader adoption of telematics capabilities across a diverse range of construction machinery types.

- Looking forward, the global construction telematics market is poised for continuous innovation and deeper integration with cutting-edge technologies. Emerging trends such as the widespread deployment of the Internet of Things (IoT), advancements in artificial intelligence (AI) for predictive analytics, and sophisticated cloud-based platforms are shaping the next generation of solutions. These advancements promise to unlock further efficiencies, enable advanced remote diagnostics, and support the industry’s ongoing evolution towards greater automation, ultimately fostering a more productive, safer, and data-driven future for the global construction sector.

- The market is increasingly moving towards flexible and optimized deployment models, with a clear shift from purely on-premise solutions to a growing preference for hybrid and multi-cloud strategies. While on-premise deployments still hold relevance for organizations with stringent security, compliance, or legacy system requirements, particularly in highly regulated industries, the overwhelming trend is towards leveraging the scalability, cost-efficiency, and agility offered by cloud environments. Hybrid cloud, which combines on-premise infrastructure with public and/or private cloud resources, is rapidly becoming the dominant model, allowing businesses to retain sensitive data on-premises while using the cloud for less critical workloads and scaling needs. Furthermore, the adoption of multi-cloud approaches, utilizing services from multiple public cloud providers, is gaining traction to avoid vendor lock-in, optimize costs, and enhance redundancy. This evolution is driven by the increasing demand for real-time data processing, the emergence of AI and machine learning applications that require immense computing power, and the need for greater flexibility and faster deployment cycles in an ever-evolving technological landscape

- The North American construction equipment telematics market, encompassing the United States, is a highly mature and rapidly expanding segment, distinguished by its early adoption of advanced technologies. This market’s growth is fundamentally driven by a strong focus on maximizing equipment utilization, significantly reducing operational costs, and adhering to stringent safety and environmental regulations. Robust investments in public infrastructure, ongoing residential and commercial construction, and a persistent demand for modernized facilities across the region collectively contribute to the increasing integration of telematics solutions into construction fleets.

- Key trends shaping the North American and US telematics landscape include the pervasive integration of the Internet of Things (IoT), artificial intelligence (AI), and cloud-based analytics into fleet management systems. These technological advancements enable more sophisticated data collection and analysis, leading to enhanced predictive maintenance capabilities, optimized fuel efficiency, and improved overall operational intelligence. Furthermore, the region is seeing an increased emphasis on sustainability, with telematics playing a crucial role in monitoring emissions and promoting eco-friendly practices, alongside a growing adoption of electric and hybrid construction equipment where telematics helps manage power consumption.

- The demand for telematics in this region is further bolstered by the need to combat a skilled labor shortage and enhance job site safety. Telematics systems provide critical insights into operator behavior and equipment conditions, enabling real-time monitoring and proactive measures to prevent accidents. The presence of leading global construction equipment OEMs and a well-developed telecommunications infrastructure in North America facilitates seamless integration and widespread adoption, positioning the US and Canada as key innovators in the evolution of connected construction machinery.

Table of Content

1. Report Scope

1.1. Market Segmentation and scope

1.2. Regional Scope

1.3. Estimates and forecast timeline

2. Market Research Methodology

2.1. Research methodology and design

2.2. Sample selection

2.3. Reliability and validity

3. Executive Summary

4. Market Analysis

4.1. Market size and growth rates

4.2. Market growth drivers, market dynamics and trends

4.3. Market scenarios and opportunity forecasts

4.4. Market constraints and challenges

4.5. Industry value chain analysis

4.6. Industry analysis – Porter’s

4.6.1. Threat of new entrants

4.6.2. Bargaining power of suppliers

4.6.3. Bargaining power of buyers

4.6.4. Threat of substitutes

4.6.5. Competitive rivalry

4.7. PEST analysis

4.7.1. Political/legal landscape

4.7.2. Economic landscape

4.7.3. Social landscape

4.7.4. Technological landscape

5. Market Breakdown – by Component

5.1. Introduction

5.2. Hardware

5.3. Software

5.4. Services

6. Market Breakdown – by Solution

6.1. Introduction

6.2. Asset Tracking & Geofencing

6.3. Fuel Management

6.4. Maintenance Monitoring / Predictive Maintenance

6.5. Diagnostics & Health Monitoring

6.6. Driver/Operator Behavior Monitoring

6.7. Fleet Safety & Compliance

6.8. Data Analytics & Reporting

6.9. Remote Control and Automation

7. Market Breakdown – by Technology

7.1. Introduction

7.2. GPS tracking

7.3. Cellular communication

7.4. IOT sensors

7.5. Machine learning

7.6. AI

7.7. Others

8. Market Breakdown – by Equipment Type

8.1. Introduction

8.2. Earthmoving Equipment

8.2.1. Excavators

8.2.2. Loaders

8.2.3. Bulldozers

8.2.4. Backhoes

8.3. Material Handling Equipment

8.3.1. Cranes

8.3.2. Forklifts

8.3.3. Telehandlers

8.4. Road Building Equipment

8.4.1. Pavers

8.4.2. Rollers

8.4.3. Graders

8.5. Concrete Equipment

8.5.1. Concrete Mixers

8.5.2. Pumps

8.6. Others

8.6.1. Trenchers

8.6.2. Scrapers

8.6.3. Compactors

9. Market Breakdown – by Deployment Model

9.1. Introduction

9.2. Cloud-Based

9.3. On-Premise

9.4. Hybrid

10. Market Breakdown – by End-User

10.1. Introduction

10.2. Construction Companies

10.3. Rental Companies

10.4. Mining & Quarrying Companies

10.5. Infrastructure Development Firms

10.6. Oil & Gas Contractors

10.7. Municipalities & Government Projects

11. Market Breakdown – by Geography

11.1. North America

11.1.1. North America Construction Equipment Telematics Market, 2025-2032

11.1.2. North America Construction Equipment Telematics Market, by Component

11.1.3. North America Construction Equipment Telematics Market, by Solution

11.1.4. North America Construction Equipment Telematics Market, by Technology

11.1.5. North America Construction Equipment Telematics Market, by Equipment Type

11.1.6. North America Construction Equipment Telematics Market, by Deployment Model

11.1.7. North America Construction Equipment Telematics Market, by End-User

11.1.8. North America Construction Equipment Telematics Market, by Country

11.1.8.1. U.S.

11.1.8.2. Canada

11.1.8.3. Mexico

11.2. South America

11.2.1. South America Construction Equipment Telematics Market, 2025-2032

11.2.2. South America Construction Equipment Telematics Market, by Component

11.2.3. South America Construction Equipment Telematics Market, by Solution

11.2.4. South America Construction Equipment Telematics Market, by Technology

11.2.5. South America Construction Equipment Telematics Market, by Equipment Type

11.2.6. South America Construction Equipment Telematics Market, by Deployment Model

11.2.7. South America Construction Equipment Telematics Market, by End-User

11.2.8. South America Construction Equipment Telematics Market, by Country

11.2.8.1. Brazil

11.2.8.2. Argentina

11.2.8.3. Others

11.3. Europe

11.3.1. Europe Construction Equipment Telematics Market, 2025-2032

11.3.2. Europe Construction Equipment Telematics Market, by Component

11.3.3. Europe Construction Equipment Telematics Market, by Solution

11.3.4. Europe Construction Equipment Telematics Market, by Technology

11.3.5. Europe Construction Equipment Telematics Market, by Equipment Type

11.3.6. Europe Construction Equipment Telematics Market, by Deployment Model

11.3.7. Europe Construction Equipment Telematics Market, by End-User

11.3.8. Europe Construction Equipment Telematics Market, by Country

11.3.8.1. Germany

11.3.8.2. France

11.3.8.3. U.K.

11.3.8.4. Italy

11.3.8.5. Spain

11.3.8.6. Sweden

11.3.8.7. Belgium

11.3.8.8. Denmark

11.3.8.9. Austria

11.3.8.10. Norway

11.3.8.11. Switzerland

11.3.8.12. Netherlands

11.3.8.13. Poland

11.3.8.14. Russia

11.3.8.15. Others

11.4. Asia-Pacific

11.4.1. APAC Construction Equipment Telematics Market, 2025-2032

11.4.2. APAC Construction Equipment Telematics Market, by Component

11.4.3. APAC Construction Equipment Telematics Market, by Solution

11.4.4. APAC Construction Equipment Telematics Market, by Technology

11.4.5. APAC Construction Equipment Telematics Market, by Equipment Type

11.4.6. APAC Construction Equipment Telematics Market, by Deployment Model

11.4.7. APAC Construction Equipment Telematics Market, by End-User

11.4.8. APAC Construction Equipment Telematics Market, by Country

11.4.8.1. China

11.4.8.2. Japan

11.4.8.3. South Korea

11.4.8.4. India

11.4.8.5. Australia

11.4.8.6. Others

11.5. Middle East & Africa

11.5.1. MEA Construction Equipment Telematics Market, 2025-2032

11.5.2. MEA Construction Equipment Telematics Market, by Component

11.5.3. MEA Construction Equipment Telematics Market, by Solution

11.5.4. MEA Construction Equipment Telematics Market, by Technology

11.5.5. MEA Construction Equipment Telematics Market, by Equipment Type

11.5.6. MEA Construction Equipment Telematics Market, by Deployment Model

11.5.7. MEA Construction Equipment Telematics Market, by End-User

11.5.8. MEA Construction Equipment Telematics Market, by Country

11.5.8.1. Saudi Arabia

11.5.8.2. UAE

11.5.8.3. Israel

11.5.8.4. South Africa

11.5.8.5. Others

12. Competitive Landscape

12.1. Global Revenue Share Analysis (%), by Leading Players

12.2. North America Revenue Share Analysis (%), by Leading Players

12.3. Europe Revenue Share Analysis (%), by Leading Players

12.4. APAC Revenue Share Analysis (%), by Leading Players

12.5. South America Revenue Share Analysis (%), by Leading Players

12.6. MEA Revenue Share Analysis (%), by Leading Players

12.7. Key Companies List

12.7.1. ABAX

12.7.2. ACTIA Group

12.7.3. Airbiquity Inc.

12.7.4. CalAmp

12.7.5. Caterpillar

12.7.6. CNH Industrial N.V.

12.7.7. Connected IO

12.7.8. CORE Telematics

12.7.9. Danfoss A/S

12.7.10. Doosan Infracore

12.7.11. Fleet Complete

12.7.12. Geotab

12.7.13. Globalstar, Inc.

12.7.14. Hemisphere GNSS, Inc.

12.7.15. Hexagon AB

12.7.16. Hitachi Construction Machinery

12.7.17. Honeywell International Inc.

12.7.18. Husqvarna Group

12.7.19. Hyundai Construction Equipment Co. Ltd.

12.7.20. Imenco

12.7.21. Inmarsat Global Limited

12.7.22. Ipsen International GmbH

12.7.23. JCB

12.7.24. John Deere

12.7.25. Komatsu

12.7.26. Kubota Corporation

12.7.27. Liebherr Group

12.7.28. LoJack Corporation (part of CalAmp)

12.7.29. Machine Control Systems (MCS)

12.7.30. Manitou Group

12.7.31. Mix Telematics

12.7.32. MOBA Mobile Automation AG

12.7.33. Navman Wireless

12.7.34. Orbcomm

12.7.35. ORBCOMM

12.7.36. Proemion GmbH

12.7.37. Samsara

12.7.38. SANY Group

12.7.39. Sierra Wireless

12.7.40. Stoneridge, Inc.

12.7.41. Teletrac Navman

12.7.42. Tenova S.p.A.

12.7.43. Terex

12.7.44. Topcon Corporation

12.7.45. Trimble

12.7.46. Verizon Connect

12.7.47. Volvo

12.7.48. Wacker Neuson SE

12.7.49. Wialon (Gurtam)

12.7.50. Xirgo Technologies (now part of Sensata Technologies)

12.7.51. ZTR Control Systems

12.7.52. Zebra Technologies