Global Anti-Surge Valves Market 2025-2032

September 24, 2025Global biologics cdmo Market 2026-2034

January 14, 2026

Global Construction Prime Power Generators Market 2025-2032

$2695 – $4195

The global market for construction prime power generators is primarily driven by the ongoing surge in infrastructure development and urbanization, especially in developing nations where stable grid power is often lacking. These generators are crucial for maintaining productivity on construction sites, providing consistent electricity for heavy machinery, tools, and temporary facilities, thereby preventing costly delays. The continuous expansion of commercial and residential building projects, coupled with significant investments in transportation and smart city initiatives, further underscores the essential need for reliable prime power solutions in this sector.

| Single User | PDF Report, PDF Report + Dashboard (Multi-Users Access), PDF Report + Dashboard (Single User Access) |

|---|

Report Summary

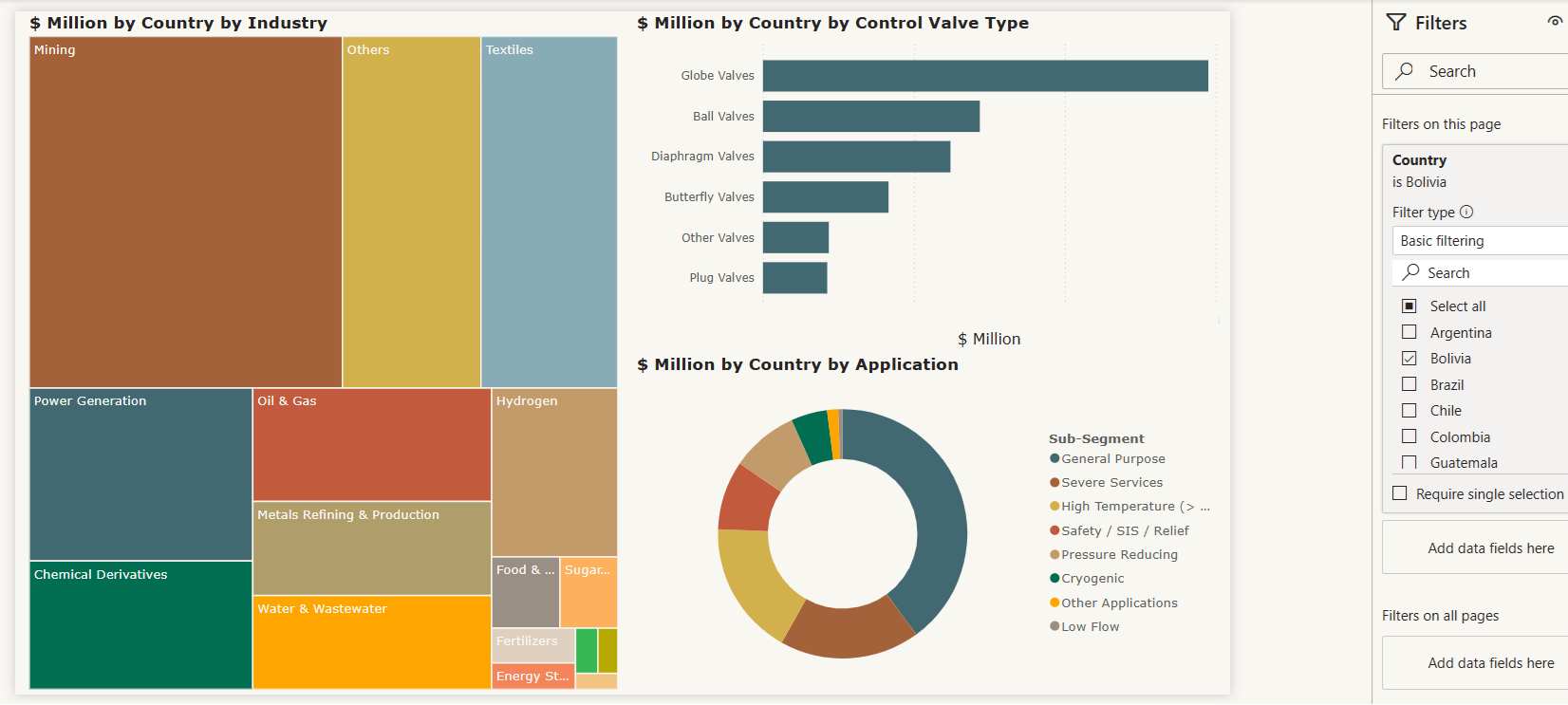

Revolutionize the way you engage with data through our cutting-edge interactive dashboard(Click to enlarge)

- The global market for construction prime power generators is primarily driven by the ongoing surge in infrastructure development and urbanization, especially in developing nations where stable grid power is often lacking. These generators are crucial for maintaining productivity on construction sites, providing consistent electricity for heavy machinery, tools, and temporary facilities, thereby preventing costly delays. The continuous expansion of commercial and residential building projects, coupled with significant investments in transportation and smart city initiatives, further underscores the essential need for reliable prime power solutions in this sector.

- Despite this robust demand, the market faces significant headwinds from volatile raw material prices and increasingly stringent environmental regulations concerning emissions and noise. The emergence of alternative power solutions, such as hybrid systems and battery storage, also intensifies the competitive landscape. Manufacturers are therefore compelled to innovate, developing advanced and sustainable generator technologies to meet these stricter standards. Looking forward, the market is set for further evolution with a strong focus on sustainability and efficiency, driving trends towards low-emission, fuel-efficient, and hybrid power solutions that often integrate with renewable energy sources. This push is supported by technological advancements like IoT-enabled remote monitoring and digital controls, enhancing operational efficiency and reliability. Additionally, the growing popularity of rental services and government initiatives promoting energy security are also key factors shaping the market’s future trajectory.

- While diesel generators continue to hold a significant market share due to their robustness, widespread availability, and high power output suitable for heavy-duty construction applications, the market is witnessing a notable diversification in fuel types driven by environmental regulations and a growing emphasis on sustainability. Natural gas generators (including those fueled by propane) are gaining traction as a cleaner-burning alternative, favored for their lower emissions and often more stable fuel costs, especially in regions with established natural gas infrastructure. Furthermore, hybrid power solutions, which typically combine a traditional generator with battery storage and sometimes integrate with renewable sources like solar, are emerging as a key trend. These systems offer reduced fuel consumption, lower emissions, and quieter operation, making them attractive for urban construction sites and projects with stringent environmental targets. Beyond these, there’s increasing interest and investment in “other” fuel types, including emerging technologies such as hydrogen fuel cells and biodiesels, as the industry explores zero or near-zero emission options to meet future sustainability goals and reduce carbon footprints on construction sites globally.

- The demand for construction prime power generators varies significantly across different applications within the global market. Industrial and infrastructure projects, including large-scale developments like commercial complexes, transportation networks, and industrial facilities, remain a primary driver, requiring high-capacity, continuous-duty generators to power heavy machinery, tools, and extensive site operations. In parallel, the commercial construction sector, encompassing offices, retail spaces, and hospitality establishments, relies on these generators to ensure uninterrupted power for lighting, HVAC systems, and critical equipment, often focusing on quieter and more fuel-efficient models for urban environments. Remote and off-grid sites, lacking access to stable grid electricity, are highly dependent on prime power generators as their sole power source, leading to demand for robust and reliable units capable of operating in challenging conditions. Lastly, while typically requiring smaller units, residential construction also contributes to the market, especially for powering temporary structures, small tools, and site offices, with a growing trend towards more portable and environmentally friendly options.

- In North America, the construction prime power generators market is characterized by a strong demand for reliable and efficient power solutions, driven by extensive infrastructure development and a robust commercial and industrial construction sector. The region, particularly the United States, sees significant investments in new building projects, road and highway construction, and the expansion of data centers, all of which necessitate continuous and high-capacity power supply. There’s a notable shift towards generators that offer better fuel economy and reduced emissions, as environmental regulations become increasingly stringent across various states and provinces. This has spurred the adoption of advanced engine technologies and a growing interest in hybrid power systems that integrate with renewable energy sources.

- The United States, as a key market within North America, demonstrates a sustained demand for prime power generators in construction, propelled by ongoing urban development and the need for uninterrupted power in remote and off-grid construction sites. The market is influenced by the stringent emission standards set by the Environmental Protection Agency (EPA), specifically the Tier 4 standards for nonroad diesel engines, which mandate significant reductions in particulate matter and nitrogen oxides. This regulatory environment is pushing manufacturers to innovate and offer cleaner, more efficient generator sets. Additionally, the increasing frequency of weather-related power outages and a general focus on energy security further underscore the importance of reliable prime power solutions in the US construction industry. The industrial sector, including large-scale construction, remains a dominant end-user, relying on these generators to ensure operational continuity and prevent costly disruptions.

- The competitive landscape for construction prime power generators in Europe is highly dynamic, marked by a strong emphasis on technological advancement and adherence to stringent environmental regulations. Leading global players like Caterpillar, Cummins, Generac, Kohler, Rolls-Royce (MTU), and Atlas Copco maintain a significant presence, leveraging their established distribution networks, broad product portfolios, and reputation for reliability. These companies are actively investing in R&D to develop cleaner, more efficient generator sets, particularly those compliant with the EU’s Stage V emission standards, which are among the most rigorous globally. The competition also involves regional specialists and a robust rental market, where companies like Aggreko play a crucial role in providing flexible power solutions that meet diverse project needs and evolving regulatory requirements.

- The European market’s competitive intensity is further shaped by the increasing demand for sustainable and smart power solutions. Manufacturers are differentiating themselves not only through compliance with emissions regulations but also by offering advanced features such as remote monitoring, predictive maintenance, and integration with renewable energy sources like solar and battery storage. This push towards hybrid and cleaner-burning (e.g., natural gas, propane) technologies creates opportunities for innovators and puts pressure on traditional diesel-focused companies to adapt. Furthermore, the varying regulatory landscapes and energy policies across different European countries, combined with a strong focus on energy security and the expansion of critical infrastructure like data centers, create a diverse playing field where companies must tailor their offerings to specific national and application-specific demands.

Table of Content

1. Report Scope

1.1. Market Segmentation and scope

1.2. Regional Scope

1.3. Estimates and forecast timeline

2. Market Research Methodology

2.1. Research methodology and design

2.2. Sample selection

2.3. Reliability and validity

3. Executive Summary

4. Market Analysis

4.1. Market size and growth rates

4.2. Market growth drivers, market dynamics and trends

4.3. Market scenarios and opportunity forecasts

4.4. Market constraints and challenges

4.5. Industry value chain analysis

4.6. Industry analysis – Porter’s

4.6.1. Threat of new entrants

4.6.2. Bargaining power of suppliers

4.6.3. Bargaining power of buyers

4.6.4. Threat of substitutes

4.6.5. Competitive rivalry

4.7. PEST analysis

4.7.1. Political/legal landscape

4.7.2. Economic landscape

4.7.3. Social landscape

4.7.4. Technological landscape

5. Market Breakdown – by Power Rating

5.1. Introduction

5.2. ≤ 50 kVA

5.3. 50 kVA – 125 kVA

5.4. 125 kVA – 200 kVA

5.5. 200 kVA – 330 kVA

5.6. 330 kVA – 750 kVA

5.7. 750 kVA

6. Market Breakdown – by Fuel Type

6.1. Introduction

6.2. Diesel

6.3. Gas (Natural Gas, Propane)

6.4. Hybrid

6.5. Others

7. Market Breakdown – by Phase

7.1. Introduction

7.2. Single-Phase

7.3. Three-Phase

8. Market Breakdown – by Mobility

8.1. Introduction

8.2. Stationary

8.3. Portable/Mobile

9. Market Breakdown – by Application

9.1.Introduction

9.2.Residential Construction

9.3.Commercial Construction

9.4.Industrial/Infrastructure Projects

9.5.Remote/Off-grid Sites

10. Market Breakdown – by Geography

10.1. North America

10.1.1. North America Construction Prime Power Generators Market, 2025-2032

10.1.2. North America Construction Prime Power Generators Market, by Power Rating

10.1.3. North America Construction Prime Power Generators Market, by Fuel Type

10.1.4. North America Construction Prime Power Generators Market, by Phase

10.1.5. North America Construction Prime Power Generators Market, by Mobility

10.1.6. North America Construction Prime Power Generators Market, by Application

10.1.7. North America Construction Prime Power Generators Market, by Country

10.1.7.1. U.S.

10.1.7.2. Canada

10.1.7.3. Mexico

10.2. South America

10.2.1. South America Construction Prime Power Generators Market, 2025-2032

10.2.2. South America Construction Prime Power Generators Market, by Power Rating

10.2.3. South America Construction Prime Power Generators Market, by Fuel Type

10.2.4. South America Construction Prime Power Generators Market, by Phase

10.2.5. South America Construction Prime Power Generators Market, by Mobility

10.2.6. South America Construction Prime Power Generators Market, by Application

10.2.7. South America Construction Prime Power Generators Market, by Country

10.2.7.1. Brazil

10.2.7.2. Argentina

10.2.7.3. Others

10.3. Europe

10.3.1. Europe Construction Prime Power Generators Market, 2025-2032

10.3.2. Europe Construction Prime Power Generators Market, by Power Rating

10.3.3. Europe Construction Prime Power Generators Market, by Fuel Type

10.3.4. Europe Construction Prime Power Generators Market, by Phase

10.3.5. Europe Construction Prime Power Generators Market, by Mobility

10.3.6. Europe Construction Prime Power Generators Market, by Application

10.3.7. Europe Construction Prime Power Generators Market, by Country

10.3.7.1. Germany

10.3.7.2. France

10.3.7.3. U.K.

10.3.7.4. Italy

10.3.7.5. Spain

10.3.7.6. Sweden

10.3.7.7. Belgium

10.3.7.8. Denmark

10.3.7.9. Austria

10.3.7.10. Norway

10.3.7.11. Switzerland

10.3.7.12. Netherlands

10.3.7.13. Poland

10.3.7.14. Russia

10.3.7.15. Others

10.4. Asia-Pacific

10.4.1. APAC Construction Prime Power Generators Market, 2025-2032

10.4.2. APAC Construction Prime Power Generators Market, by Power Rating

10.4.3. APAC Construction Prime Power Generators Market, by Fuel Type

10.4.4. APAC Construction Prime Power Generators Market, by Phase

10.4.5. APAC Construction Prime Power Generators Market, by Mobility

10.4.6. APAC Construction Prime Power Generators Market, by Application

10.4.7. APAC Construction Prime Power Generators Market, by Country

10.4.7.1. China

10.4.7.2. Japan

10.4.7.3. South Korea

10.4.7.4. India

10.4.7.5. Australia

10.4.7.6. Others

10.5. Middle East & Africa

10.5.1. MEA Construction Prime Power Generators Market, 2025-2032

10.5.2. MEA Construction Prime Power Generators Market, by Power Rating

10.5.3. MEA Construction Prime Power Generators Market, by Fuel Type

10.5.4. MEA Construction Prime Power Generators Market, by Phase

10.5.5. MEA Construction Prime Power Generators Market, by Mobility

10.5.6. MEA Construction Prime Power Generators Market, by Application

10.5.7. MEA Construction Prime Power Generators Market, by Country

10.5.7.1. Saudi Arabia

10.5.7.2. UAE

10.5.7.3. Israel

10.5.7.4. South Africa

10.5.7.5. Others

11. Competitive Landscape

11.1. Global Revenue Share Analysis (%), by Leading Players

11.2. North America Revenue Share Analysis (%), by Leading Players

11.3. Europe Revenue Share Analysis (%), by Leading Players

11.4. APAC Revenue Share Analysis (%), by Leading Players

11.5. South America Revenue Share Analysis (%), by Leading Players

11.6. MEA Revenue Share Analysis (%), by Leading Players

11.7. Key Companies List

11.7.1. Aggreko

11.7.2. Aksa Power Generation

11.7.3. Atlas Copco

11.7.4. Briggs & Stratton

11.7.5. Caterpillar

11.7.6. Cummins

11.7.7. Doosan (Doosan Portable Power)

11.7.8. FG Wilson

11.7.9. Generac Power Systems

11.7.10. HIMOINSA

11.7.11. Honda Siel Power Products Limited

11.7.12. JCB (J.C. Bamford Excavators Ltd)

11.7.13. KOHLER Co. (including SDMO)

11.7.14. Kubota Corporation

11.7.15. Mitsubishi Heavy Industries

11.7.16. Perkins Engines Company Limited

11.7.17. PowerLink

11.7.18. Rehlko

11.7.19. Rolls-Royce

11.7.20. Scania

11.7.21. Siemens Energy

11.7.22. Volvo Penta

11.7.23. Wacker Neuson

11.7.24. Wärtsilä

11.7.25. Weichai Holding Group Co. Ltd.

11.7.26. YANMAR Holdings