Global Real-World Data (RWD) Market 2025-2032

September 17, 2025Global Anti-Surge Valves Market 2025-2032

September 24, 2025

Global Life Science Analytics Market 2025-2032

$3695 – $5195

The global life science analytics market is undergoing a profound transformation, primarily propelled by the imperative to standardize and integrate a burgeoning volume of diverse data sources. This includes critical information from clinical trials, electronic health records, genomic sequencing, and real-world evidence, all requiring seamless exchange across platforms and regions to unlock their full potential. This drive for comprehensive data integration is fundamental to advancing insights and optimizing processes across the entire life science value chain.

| Single User | PDF Report, PDF Report + Dashboard (Multi-Users Access), PDF Report + Dashboard (Single User Access) |

|---|

Report Summary

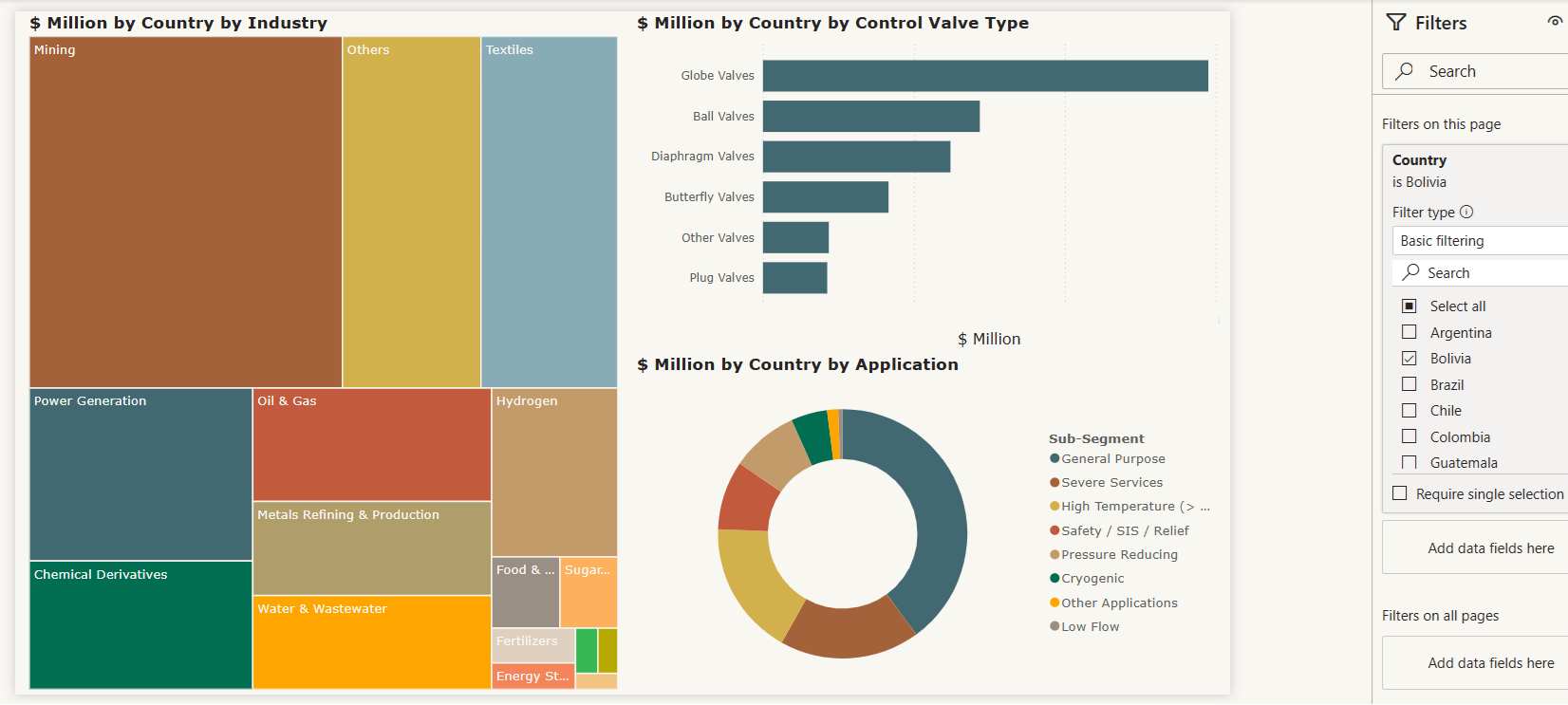

Revolutionize the way you engage with data through our cutting-edge interactive dashboard(Click to enlarge)

- The global life science analytics market is undergoing a profound transformation, primarily propelled by the imperative to standardize and integrate a burgeoning volume of diverse data sources. This includes critical information from clinical trials, electronic health records, genomic sequencing, and real-world evidence, all requiring seamless exchange across platforms and regions to unlock their full potential. This drive for comprehensive data integration is fundamental to advancing insights and optimizing processes across the entire life science value chain.

- Technological innovation serves as a crucial catalyst for this market’s evolution. Advanced capabilities in artificial intelligence, including generative AI and machine learning, coupled with the power of cloud-based analytics, have significantly simplified the complex task of data analysis. These advancements empower organizations to convert vast amounts of raw data into actionable insights, accelerating critical functions such as drug discovery, streamlining clinical trials, ensuring regulatory compliance, and enhancing pharmacovigilance efforts. The ability to derive rapid intelligence from data is reshaping operational efficiencies.

- The pharmaceutical and clinical trial industries, in particular, are witnessing a paradigm shift driven by the widespread adoption of analytics. This transformation is fueled by an urgent demand for faster drug development cycles and more efficient trial execution. By leveraging sophisticated analytics tools to examine diverse data — including patient demographics, historical records, inputs from remote monitoring, and insights gleaned from previous trials — companies can streamline clinical processes, leading to accelerated innovation and improved patient outcomes.

- In 2024, the descriptive analytics segment dominated the market’s revenue, largely because of its vital role in summarizing past data and generating practical insights. This capability allows pharmaceutical and biotech firms to effectively monitor clinical trial performance, understand patient demographics, and track drug efficacy trends. It’s also extensively utilized for essential tasks like regulatory reporting, sales forecasting, and operational benchmarking.

- Meanwhile, the predictive analytics segment is experiencing the fastest growth in the life science analytics market. This surge is fueled by the critical need to anticipate future outcomes and refine decision-making in drug development and patient care. By leveraging both historical and real-time data, predictive models are instrumental in forecasting disease progression, estimating trial success rates, and predicting treatment responses. This forward-looking approach enables pharmaceutical companies to significantly reduce risks, control costs, and boost the overall efficiency of their research and development efforts

- In 2024, the on-demand segment secured the largest portion of the market’s revenue and is projected to see the fastest growth over the forecast period. This expansion is largely due to its inherent scalability, cost-efficiency, and ease of access. Cloud-based, on-demand solutions empower pharmaceutical and biotech firms to utilize advanced analytics tools without needing substantial upfront infrastructure investments. This also facilitates real-time data analysis and seamless collaboration among global teams. This model’s support for rapid deployment, remote data sharing, and effortless updates makes it particularly well-suited for the dynamic environments of clinical trials and pharmacovigilance.

- Conversely, the on-premise segment is also anticipated to experience notable growth within the market. This is primarily driven by a strong demand for enhanced data security, stringent regulatory compliance, and greater internal control. Large pharmaceutical and biotech companies often favor on-premise solutions for managing highly sensitive clinical and patient data, especially in regions with strict data localization laws. These systems additionally offer extensive customization options and seamless integration with existing legacy infrastructure

- North America holds the largest share of the global life science analytics market. This dominance is attributed to its well-established pharmaceutical and biotechnology sectors, the strong presence of leading analytics providers, and the widespread embrace of advanced technologies like AI, machine learning, and cloud computing. The region further benefits from a high volume of clinical research, a mature healthcare IT infrastructure, and consistent investment in data-driven drug development and personalized medicine initiatives.

- Within North America, the U.S. market is the undisputed leader. This is thanks to its robust ecosystem of pharmaceutical, biotech, and healthcare technology companies that consistently invest in data-driven research and development. The country also boasts a high concentration of clinical trial activity and is a pioneer in adopting advanced analytics methods, including AI, machine learning, and real-world data integration.

- Ongoing strategic collaborations and continuous technological innovations are further enhancing clinical efficiency, accelerating drug discovery, and strengthening personalized medicine efforts in the U.S., firmly cementing its position at the forefront of the market

- The competitive landscape of the life science analytics market in Europe is dynamic and highly influenced by global trends and the presence of major international players. The market is characterized by intense competition as companies vie to offer comprehensive solutions that address the complex data needs of the pharmaceutical, biotechnology, and medical device industries across the continent. Key competitive differentiators include the depth and breadth of data integration capabilities, the sophistication of analytical tools (especially in AI and machine learning), and the ability to navigate diverse European regulatory environments

- Leading companies such as IQVIA, Oracle, Accenture, Merative, and SAS Institute maintain a significant competitive edge in Europe due to their extensive product portfolios, established client bases, and deep pockets for research and development. These players are focused on strategic collaborations and continuous technological innovation to enhance clinical efficiency, accelerate drug discovery, and advance personalized medicine efforts. Their competitive strategies often involve expanding cloud-based offerings, investing heavily in AI-powered analytics, and building robust ecosystems of partnerships to provide end-to-end solutions.

- However, the European market also features a vibrant ecosystem of smaller, specialized analytics firms and health tech startups. These companies often compete by focusing on niche areas, offering highly customized solutions, or excelling in specific regional markets where they might have a deeper understanding of local regulatory nuances and healthcare systems. The increasing pressure on healthcare spending, the demand for improved data standardization, and the growing adoption of analytics in clinical trials are all factors shaping the competitive dynamics, driving both consolidation among larger players and innovation from agile new entrants.

Table of Content

1. Report Scope

1.1. Market Segmentation and scope

1.2. Regional Scope

1.3. Estimates and forecast timeline

2. Market Research Methodology

2.1. Research methodology and design

2.2. Sample selection

2.3. Reliability and validity

3. Executive Summary

4. Market Analysis

4.1. Market size and growth rates

4.2. Market growth drivers, market dynamics and trends

4.3. Market scenarios and opportunity forecasts

4.4. Market constraints and challenges

4.5. Industry value chain analysis

4.6. Industry analysis – Porter’s

4.6.1. Threat of new entrants

4.6.2. Bargaining power of suppliers

4.6.3. Bargaining power of buyers

4.6.4. Threat of substitutes

4.6.5. Competitive rivalry

4.7. PEST analysis

4.7.1. Political/legal landscape

4.7.2. Economic landscape

4.7.3. Social landscape

4.7.4. Technological landscape

5. Market Breakdown – by Type of Analytics/Product

5.1. Introduction

5.2. Descriptive Analytics

5.3. Predictive Analytics

5.4. Prescriptive Analytics

5.5. Diagnostic Analytics

5.6. Reporting Analytics

5.7. Discovery Analytics

6. Market Breakdown – by Component

6.1. Introduction

6.2. Software

6.3. Services

7. Market Breakdown – by Deployment Model

7.1. Introduction

7.2. On-premise

7.3. On-demand/Cloud-based

8. Market Breakdown – by End-User

8.1. Introduction

8.2. Pharmaceutical and Biotechnology Companies

8.3. Medical Device Companies

8.4. Contract Research Organizations (CROs)

8.5. Research Institutes and Universities

8.6. Third-Party Administrators (TPAs)

8.7. Healthcare Providers

9. Market Breakdown – by Geography

9.1. North America

9.1.1. North America Life Science Analytics Market, 2025-2032

9.1.2. North America Life Science Analytics Market, by Type of Analytics/Product

9.1.3. North America Life Science Analytics Market, by Component

9.1.4. North America Life Science Analytics Market, by Deployment Model

9.1.5. North America Life Science Analytics Market, by End-User

9.1.6. North America Life Science Analytics Market, by Country

9.1.6.1. U.S.

9.1.6.2. Canada

9.1.6.3. Mexico

9.2. South America

9.2.1. South America Life Science Analytics Market, 2025-2032

9.2.2. South America Life Science Analytics Market, by Type of Analytics/Product

9.2.3. South America Life Science Analytics Market, by Component

9.2.4. South America Life Science Analytics Market, by Deployment Model

9.2.5. South America Life Science Analytics Market, by End-User

9.2.6. South America Life Science Analytics Market, by Country

9.2.6.1. Brazil

9.2.6.2. Argentina

9.2.6.3. Others

9.3. Europe

9.3.1. Europe Life Science Analytics Market, 2025-2032

9.3.2. Europe Life Science Analytics Market, by Type of Analytics/Product

9.3.3. Europe Life Science Analytics Market, by Component

9.3.4. Europe Life Science Analytics Market, by Deployment Model

9.3.5. Europe Life Science Analytics Market, by End-User

9.3.6. Europe Life Science Analytics Market, by Country

9.3.6.1. Germany

9.3.6.2. France

9.3.6.3. U.K.

9.3.6.4. Italy

9.3.6.5. Spain

9.3.6.6. Sweden

9.3.6.7. Belgium

9.3.6.8. Denmark

9.3.6.9. Austria

9.3.6.10. Norway

9.3.6.11. Switzerland

9.3.6.12. Netherlands

9.3.6.13. Russia

9.3.6.14. Others

9.4. Asia-Pacific

9.4.1. APAC Life Science Analytics Market, 2025-2032

9.4.2. APAC Life Science Analytics Market, by Type of Analytics/Product

9.4.3. APAC Life Science Analytics Market, by Component

9.4.4. APAC Life Science Analytics Market, by Deployment Model

9.4.5. APAC Life Science Analytics Market, by End-User

9.4.6. APAC Life Science Analytics Market, by Country

9.4.6.1. China

9.4.6.2. Japan

9.4.6.3. South Korea

9.4.6.4. India

9.4.6.5. Australia

9.4.6.6. Others

9.5. Middle East & Africa

9.5.1. MEA Life Science Analytics Market, 2025-2032

9.5.2. MEA Life Science Analytics Market, by Type of Analytics/Product

9.5.3. MEA Life Science Analytics Market, by Component

9.5.4. MEA Life Science Analytics Market, by Deployment Model

9.5.5. MEA Life Science Analytics Market, by End-User

9.5.6. MEA Life Science Analytics Market, by Country

9.5.6.1. Saudi Arabia

9.5.6.2. UAE

9.5.6.3. Israel

9.5.6.4. Others

10. Competitive Landscape

10.1. Global Revenue Share Analysis (%), by Leading Players

10.2. North America Revenue Share Analysis (%), by Leading Players

10.3. Europe Revenue Share Analysis (%), by Leading Players

10.4. APAC Revenue Share Analysis (%), by Leading Players

10.5. South America Revenue Share Analysis (%), by Leading Players

10.6. MEA Revenue Share Analysis (%), by Leading Players

10.7. Key Companies List

10.7.1. Accenture

10.7.2. Allscripts Healthcare Solutions, Inc.

10.7.3. Amazon Web Services, Inc.

10.7.4. Axtria

10.7.5. Beamtree

10.7.6. CitiusTech

10.7.7. Clarivate

10.7.8. Cognizant

10.7.9. Elsevier

10.7.10. Genedata

10.7.11. Google LLC

10.7.12. Inovalon

10.7.13. IQVIA

10.7.14. IXICO

10.7.15. Komodo Health, Inc.

10.7.16. MaxisIT Inc.

10.7.17. Merative

10.7.18. Microsoft

10.7.19. Optum

10.7.20. Oracle

10.7.21. Salesforce

10.7.22. SAS Institute

10.7.23. SCIO Health Analytics

10.7.24. SDG Group

10.7.25. Sophia Genetics

10.7.26. ThoughtSphere

10.7.27. ThoughtSpot

10.7.28. Veeva Systems

10.7.29. Veradigm